A Primer on the Standardized Approach to Credit Risk

The Bank for International Settlements (BIS) regulatory body has proposed using a standardized approach to credit risk (SA-CR) when measuring credit risk. Banks using intelligent process automation (IPA) may leverage the approach to ensure compliance with the new due diligence requirements.

Most of the recent regulatory changes or guidelines being issued by BIS (Bank for International Settlements) are focusing heavily on aspects such as increased transparency, granularity and comparability among the regulated banks. One such regulation set to overhaul the measurement of credit risk is the standardized approach for credit risk (SA-CR), which is currently in the proposal stages.

The new SA-CR guidelines seek to strengthen the existing regulatory capital standard by reducing reliance on external credit ratings, enhancing granularity, improving risk sensitivity and updating risk weight calibrations.

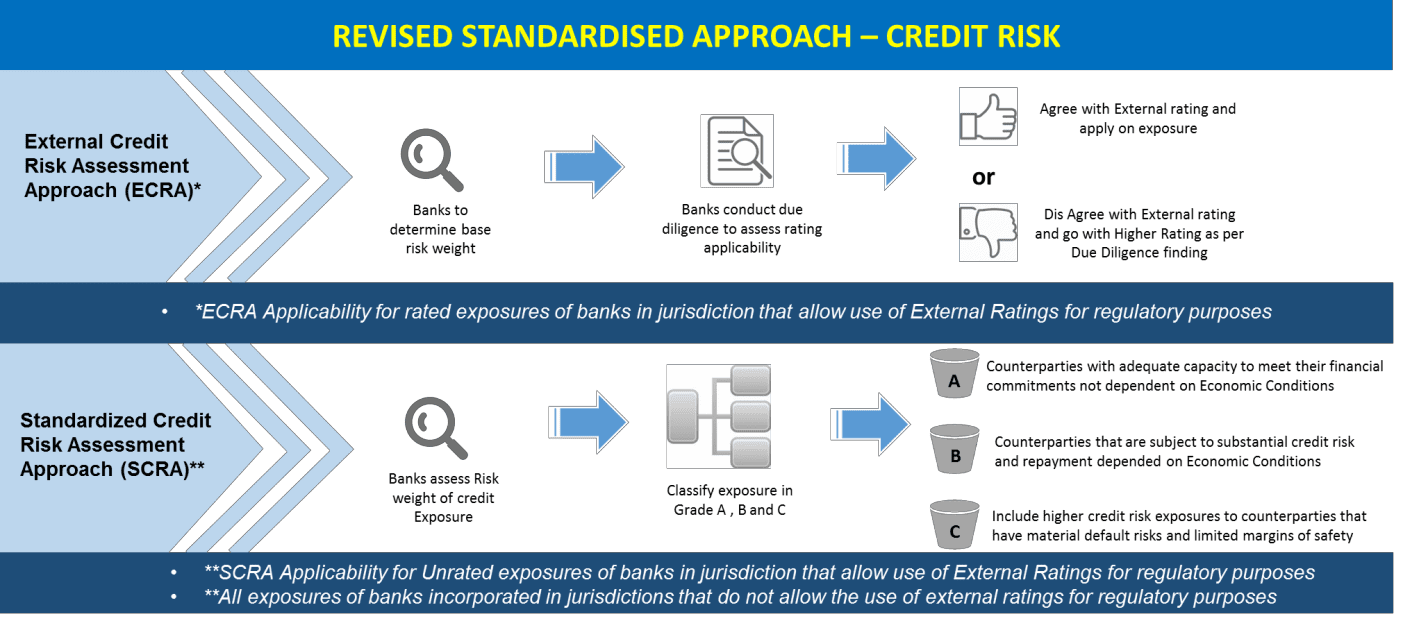

Reducing mechanistic reliance on external credit ratings is the key focus area of the SA-CR guidelines. The primary objective here is to discourage banks from relying mechanistically on external ratings for the assessment of an asset’s creditworthiness. The proposal states the banks should be able to conduct their own assessment of credit exposures. It also lists out approaches that the banks can follow. The below diagram gives an illustration of the approaches and their applicability.

Figure 1 – Overview of Proposed Standardized Approach to Credit Risk

While there are a host of risk weight changes mentioned in the regulation, due diligence requirements also form a crucial part of this guideline. They focus on:

- Assessment of a Counterparty’s Risk Profile – As per these guidelines, banks are mandated to perform due diligence to understand and assess the risk profile of their counterparties. Banks should be able to assess operating and financial performance by conducting internal credit analysis, and they can also leverage analytics to gain insights and understand the patterns of the counterparty’s performance. Though the requirement states that such analysis should be conducted at least on an annual basis, it also suggests that the banks should gather relevant information about the counterparty on a regular basis for conducting the analysis.

- Monitoring and Control of the Assessment Process – The guidelines also emphasize having proper internal controls, policies and processes around the entire process to ensure correct risk weights are getting assigned to counterparties. This also helps banks in demonstrating to the regulators that the due diligence process established is

From an impact perspective, in case of due diligence requirements, banks will need to set up processes, policies and controls to effectively conduct the due diligence exercise. As the due diligence requirements require conducting credit analysis and studying patterns, intelligent process automation can act as a potential solution for banks to leverage for conducting the due diligence exercise and complying with the new SA-CR standards.

In simple terms, intelligent process automation is a combination of robotic process automation (RPA) and machine learning techniques. The RPA component mimics standard activities that are manual and repetitive in nature, whereas the machine learning (ML) component helps the process to improve over a period of time without any human intervention.

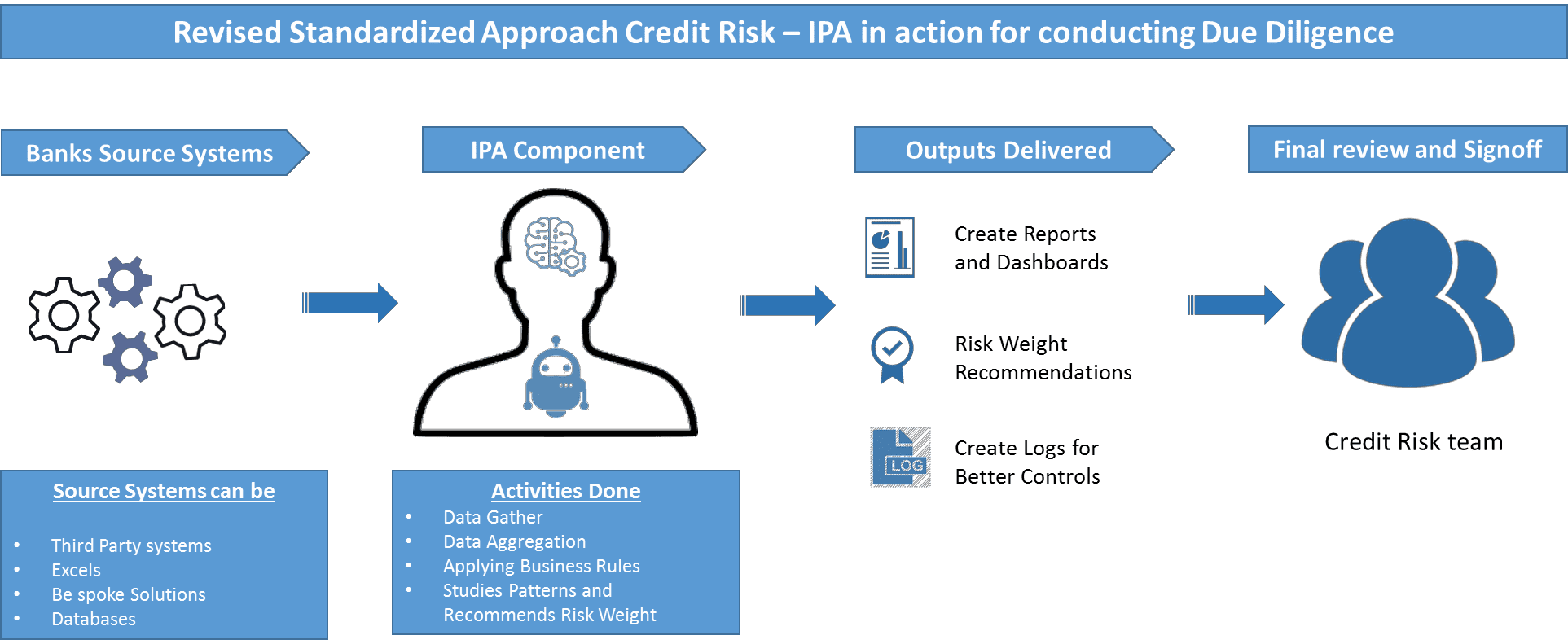

In the case of SA-CR due diligence requirements, the RPA component can help automate the standard activities which involve:

- Integrating with internal systems to gather counterparty information

- Collating and aggregating data as required for the due diligence

- Conducting business analysis based on rules defined by the banks’ business teams

- Creating final reporting templates and dashboards

The ML component of IPA helps banks to study the trends and patterns in a counterparty’s behaviors, and it can provide analytical inputs to the credit risk team for assessing the correct risk weight. It is to be noted here that the ML component will provide only recommendations to the credit risk team; the final authority to assess the risk weight still rests with the bank’s credit risk team. The objective of the ML component here is to expedite the process by giving the required input, which will aid in the risk weight assignment and also provide the required qualitative commentary in the due diligence report. The ML component has self-learning capabilities and over period of time becomes more efficient based on the learnings it captures. The below diagram illustrates a high-level view of the IPA solution in action.

Figure 2 – Due Diligence Requirements addressed through IPA

The IPA solution also comes in with a host of benefits in terms of:

- Quicker time to implementation.

- Auditable and traceable actions; the solution can create logs and dashboards, helping the user get information on the status of the automation run, exceptions encountered during the run, etc. This helps in meeting the internal controls requirement of the due diligence

- A noninvasive approach, enabling seamless integration over the existing

- Providing the banks an option to run an on-demand or regular analysis on

Banks are constantly grappling with regulatory pressure to meet newer regulations and manage existing ones. In such scenarios, IPA solutions can provide banks a necessary breather, enabling them to comply with newer regulations with the required agility in a short span of time and also creating cost-efficient processes that are more controlled and auditable.

Ajay Katara is a Domain Consultant with the Banking Industry Advisory Group at Tata Consultancy Services (TCS). He currently heads the Solution and Strategy for Enterprise Risk and Compliance Regulations. Ajay has extensive experience of more than 15 years in the Consulting & Solution design space cutting across CCAR Consulting, AML, Basel II implementation and credit risk, and he has worked with several financial enterprises across geographies. He has significantly contributed to the conceptualization of strategic offerings in the risk management space and has been instrumental in successfully driving various consulting engagements. He has also authored many editorials, details of which can be found on his

Ajay Katara is a Domain Consultant with the Banking Industry Advisory Group at Tata Consultancy Services (TCS). He currently heads the Solution and Strategy for Enterprise Risk and Compliance Regulations. Ajay has extensive experience of more than 15 years in the Consulting & Solution design space cutting across CCAR Consulting, AML, Basel II implementation and credit risk, and he has worked with several financial enterprises across geographies. He has significantly contributed to the conceptualization of strategic offerings in the risk management space and has been instrumental in successfully driving various consulting engagements. He has also authored many editorials, details of which can be found on his