Sujata Dasgupta is the Practice Head for Financial Crimes Compliance in Tata Consultancy Services Ltd. and is based out of Stockholm, Sweden. She is an experienced industry consultant in banking risk and compliance (R&C), with a demonstrated history of working in banking, IT services and consulting, having worked for global banking clients in all major financial hubs, viz. New York, London, Singapore, Hong Kong, Frankfurt and now Stockholm. She also authors articles on risk and compliance in international banking R&C journals.

Sujata Dasgupta's Latest Columns

New UK Law Shines a Light on Internal Fraud Surveillance

‘Failure to prevent fraud’ could result in harsh penalties

European Regulators Moving the Needle on Real-Time AML Monitoring

Financial institutions may have adopted methods of detecting fraud in real time, but money laundering detection remains an after-the-fact judgment....

Big Benefits of Advanced Tech for FinCrime Compliance Don’t Kick in Until Silos Are Toppled

Companies increasingly have the advanced tools to combat financial crime, but as industry specialist Sujata Dasgupta explains, the fragmented nature...

In the Fight Against Fincrime, Update Your Platforms, Upgrade Your Processes and Don’t Forget to Upskill Your People

During the past two decades, we have witnessed how financial crime compliance (FCC) has evolved from a basic customer identification...

FinCEN’s Registry Will Be a Game-Changer. It Will Also Place an Added Burden on Corporations.

The Corporate Transparency Act (CTA) passed last year mandates FinCEN to establish a national registry of ultimate beneficial ownership (UBO)...

Realizing Dynamic KYC in Banking

Sujata Dasgupta explores the emerging concept of perpetual, dynamic KYC and analyzes how AI-powered solutions can form the building blocks...

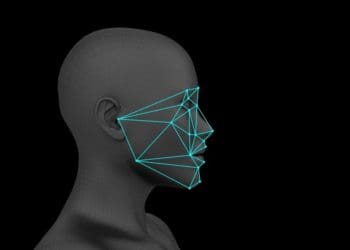

Evolution of Dynamic Biometrics: Disrupting the Fraud Prevention Landscape

In the last six months, practically everything has gone digital, creating a mountain of new digital data for fraudsters to...

Future-Proofing FinCrime Compliance Against Disasters

The banking sector is facing a dire situation with respect to rising fraud and money laundering amid the coronavirus pandemic....

Will the Dutch AML Utility be a Game Changer for Shared FinCrime Compliance?

Sujata Dasgupta provides an analysis of the upcoming Dutch AML utility – currently under feasibility study – and how it...

Automating KYC Compliance with Smart ID&V

As customers increasingly prefer to do their banking via smart devices, it’s time for banks to modernize their approach to...