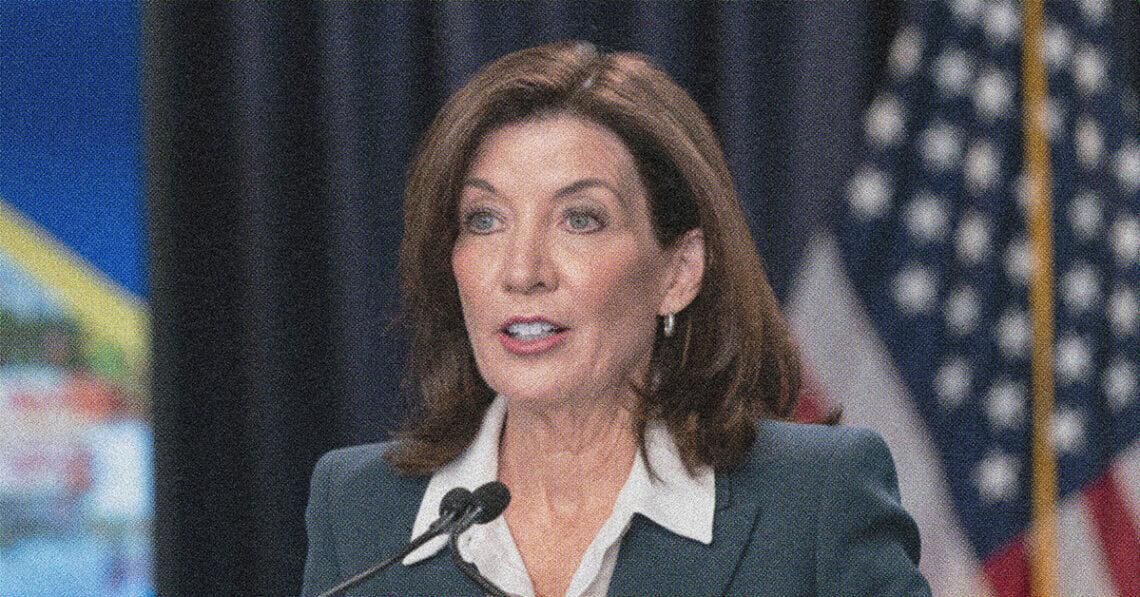

Over the summer, New York lawmakers passed the New York LLC Transparency Act, aimed at combating money laundering and other illegal activities conducted through shell companies. Gov. Kathy Hochul has yet to sign the measure, making it unclear whether it will become law in the Empire State. It may sound familiar to followers of the soon-to-be enforced Corporate Transparency Act, but as a trio of experts from BakerHostetler reveal, New York’s law goes further in one major aspect: Its LLC database would be public.

Steven H. Goldberg, Jennifer R. Rodriguez and Samuel F. Toth co-authored this article.

More than a year after it was introduced to the New York State Legislature, the New York Transparency Act was passed by both the New York State Assembly and the New York State Senate in late June; however, as of the date of this article, the bill remains subject to review by Gov. Kathy Hochul before becoming law, and it is unclear whether she will sign it. If she does not sign the bill, the NYTA may still become law if a two-thirds majority of both houses of the New York State Legislature votes in favor of it.

Like the federal Corporate Transparency Act, goes into effect Jan. 1, 2024, the NYTA is designed to combat money laundering and other illegal acts committed through anonymous shell companies.

If it becomes law, the NYTA will require all LLCs formed or registered to do business in New York to disclose to the state the same beneficial ownership information that such LLCs will need to disclose to the FinCEN under the CTA.

While both pieces of legislation have similar goals and impose similar disclosure obligations, they differ drastically in terms of the use and availability of the information submitted. Under the CTA, the beneficial ownership database is kept confidential and may be accessed only by law enforcement agencies and financial institutions in limited circumstances. But under the NYTA, the names and business addresses of the beneficial owners of LLCs will be made publicly available in a searchable database.

The NYTA would take effect one year after becoming law. If an LLC is formed or applies to do business in New York after the effective date, its formation document or application to do business will need to include the beneficial ownership information required by the NYTA. Existing LLCs formed or registered to do business in New York must amend their articles of organization or application for authority no later than Jan. 1, 2025.

Beneficial owner disclosure requirements

The CTA requires every corporation, LLC or other similar entity that meets the definition of a “reporting company” to make a filing with FinCEN identifying its applicant and beneficial owner information. The NYTA would cover only LLCs (both domestic New York-formed LLCs and out-of-state LLCs qualified to do business in New York) and does not apply to applicants (i.e., the one or two individuals primarily responsible for drafting and filing an LLC’s formation documents) but otherwise contains disclosure requirements similar to the CTA.

Under the NYTA, a manager or member of an applicable LLC would be required to indicate, in the entity’s articles of organization or application for authority to do business in New York filed with the Department of State, whether the LLC is a “reporting company” (which is defined by the NYTA to have the same meaning as in the CTA) or an “exempt company” (which is a new term created by the NYTA to mean any LLC that meets one of the listed exemptions from the definition of a reporting company enumerated in the CTA). This disclosure obligation goes beyond what is required by the CTA, under which exempt companies have no affirmative obligation to state or otherwise confirm that they are, in fact, exempt.

If an LLC is a reporting company, its articles of organization or application for authority would be required to include disclosures with respect to each of its beneficial owners. The LLC may file a copy of its FinCEN report to satisfy these requirements if such report contains all the personal information required by the NYTA, which may not always be the case. The CTA gives individuals the option to apply for a FinCEN identifier, which can then be used in lieu of their personal information. Therefore, if a report submitted to FinCEN includes a FinCEN identifier, that report would not have all the information required by the NYTA.

The definition of the term “beneficial owner” is also incorporated by reference into the NYTA from the CTA. Subject to certain exclusions, it refers to any “individual who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise (i) exercises substantial control over the entity[] or (ii) owns or controls not less than 25 percent of the ownership interests of the entity.”

Required disclosure with respect to each beneficial owner includes their:

- Full legal name.

- Date of birth.

- Current business street address.

- A unique identifying number from an acceptable identification document defined in 31 U.S.C. § 5336 (a)(1) (which may be a nonexpired U.S. passport, a nonexpired identification document issued by a state or local government or Indian tribe to the individual for the purpose of identifying that individual, a nonexpired driver’s license issued by a state, or if the individual does not have any of the foregoing documents, a nonexpired passport issued by a foreign government). Unlike the CTA, the NYTA does not require a photocopy of the identification document tied to such unique identifying number.

The foregoing information is required to be updated by an LLC formed in New York within 90 days after any change by way of an amendment to its articles of organization. Out-of-state LLCs qualified to do business in New York are required to provide updated information by way of amendments to their applications for authority to do business in New York, although a deadline for such amendment is not expressly stated. The NYTA says only that updates must be made by such LLCs “upon any change in the beneficial owner information.”

Public database of beneficial owners

Perhaps the biggest material departure from the CTA is the NYTA’s establishment of a searchable public database containing the names and business addresses of the beneficial owners of such LLCs. This type of publicly searchable database — which Assemblywoman Emily Gallagher, co-author of the NYTA, argues is the “gold-standard policy for beneficial ownership transparency” — does not currently exist at the federal level or in any other U.S. state.

Not all personal information submitted will be publicly available. The NYTA provides that the dates of birth and unique identifying numbers of the beneficial owners will “be deemed confidential except for the purposes of law enforcement, or as otherwise required to be disclosed pursuant to a court order.” But notably, it remains unclear (i) how the Department of State will maintain the confidentiality of such personal information (for example, if an individual orders a copy of a reporting company’s articles of organization or application for authority, will the Department of State provide a redacted copy of such document?) and (ii) what will be deemed permissible purposes for law enforcement and under what authority a court may order such information to be disclosed.

The NYTA gives the New York secretary of state responsibility for promulgating regulations to allow beneficial owners with “significant privacy interests” to apply for waivers to keep their name and/or business street address confidential; however, it is unlikely those interests will be interpreted broadly. The NYTA specifies only that whistleblowers using LLCs to file False Claims Act lawsuits and individuals participating in an address confidentiality program will each be deemed to have significant privacy interests exempting them from inclusion in the public database. This may indicate that only very special circumstances are intended to qualify an individual for a waiver.

Penalties for nondisclosure, fraudulent disclosure & unauthorized disclosure or use

The CTA and NYTA also differ in their approach to penalties for noncompliance. The CTA imposes significant civil and potentially criminal penalties for failures to disclose or fraudulent disclosures of required information, whereas the NYTA provides for only a $250 fine if delinquency continues for two years and is not remedied within 60 days of notice thereof.

Further, the CTA imposes especially severe civil and potentially criminal penalties for unauthorized disclosure or use of beneficial owner information disclosed in a report submitted to FinCEN or pursuant to a permitted disclosure by FinCEN to a government authority or financial institution. Such penalties may include up to a $500,000 fine or up to 10 years in prison if such action is taken while violating another U.S. law or as part of a pattern of illegal activity involving more than $100,000 in a 12-month period. The severity of such penalties may give disclosing companies some comfort as to FinCEN’s concern for protecting the confidentiality of their beneficial ownership information. The NYTA offers no comfort in this regard, as it contains no corresponding penalty for unauthorized disclosure or misuse of information provided on a confidential basis to the Department of State.

It is possible that in taking a lighter approach to the penalty for omitted or fraudulent disclosure, the drafters of the NYTA have sought to balance crime prevention efforts against a potential chilling effect on individuals’ desire to form or operate businesses in New York, which could occur if doing so created too much potential liability. However, the lack of a penalty under the NYTA for unauthorized disclosure or use of beneficial ownership information is more difficult to readily explain.

Enhanced compliance burdens and risks to personal information for those who own or control multiple LLCs

The lack of the ability to use a unique identifier under the NYTA in the same way as under the CTA has the potential to result in enhanced compliance burdens and risks to personal information, particularly for those who own or control multiple LLCs, such as real estate developers or family offices.

Under the CTA, a reporting company may provide the FinCEN identifiers of its beneficial owners in lieu of submitting their personal information in connection with such company’s beneficial ownership information report; however, under the NYTA, beneficial owners must submit their personal information to the Department of State for each covered LLC. In practice, this means that a beneficial owner who forms or controls multiple LLCs covered by the NYTA must transmit their sensitive personal information multiple times to the Department of State. Due to the risk inherent in the transmission of personal information (such as driver’s license or passport details), individuals who own or control multiple covered LLCs may be uncomfortable transmitting such information numerous times.

Additionally, if a beneficial owner experiences a change in their personal information (such as a change of business address), under the CTA, such beneficial owner could update the information associated with their FinCEN identifier (if applicable), and by virtue of such update, the information would be updated with respect to each reporting company associated with that FinCEN identifier. In contrast, under the NYTA, if a beneficial owner experiences a change in their personal information, they must amend the articles of organization or application for authority to do business in New York for each LLC they beneficially own. This may become a frustrating compliance burden for those who own or control numerous covered LLCs.

Conclusion

The disclosure requirements under the proposed legislation are few, but they may create sensitivities among LLC owners and operators because they involve personal information that was not previously required to be disclosed, some of which will be made public. Owners of covered LLCs and people considering expanding their businesses into New York should review the NYTA to familiarize themselves with disclosure requirements applicable to their entities, to understand what information would be made publicly available and to consider, in a timely manner, whether the foregoing will have any impact on their continued desire to domicile or operate their LLCs in New York.