The Panama Papers revealed one of the most scrutinized secrets on how corrupt, high-profile people from around the world — from politicians to the ultra rich — use tax havens to hide the source and true owners of their wealth.

To provide a brief on the papers, I have summarized below the most important points we need to know:

What is the leak?

More than 11.5 million documents from the database of Mossack Fonseca (the world’s fourth-largest offshore law firm) were obtained from an anonymous source and shared with the German newspaper Süddeutsche Zeitung.

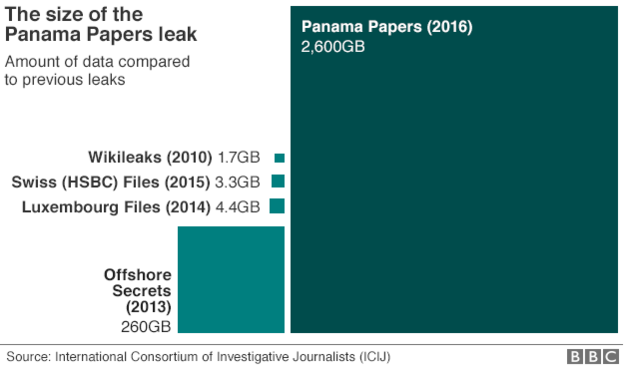

How big is it?

The biggest in history!

Who was affected?

Below is a list of the most well-known individuals, entities, associates, and relatives revealed through the leak.

President of Russia

President of China

Prime Minister of UK

President of Ukraine

President of Argentina

Prime Minister of Pakistan

Prime Minister of Iceland

King of Saudi Arabia

President of UAE

Former President of Egypt

Former President of Sudan

Former President of Libya

Former Head of State of Qatar

Former Prime Minister of Iraq

Lionel Messi (the Argentine football star)

Jackie Chan (the actor)

And dozens of ministers and parliament members in various countries including Canada, France, UK, India, China, Italy, Malaysia, Mexico, South Africa, Spain, and Syria.

What are the facts?

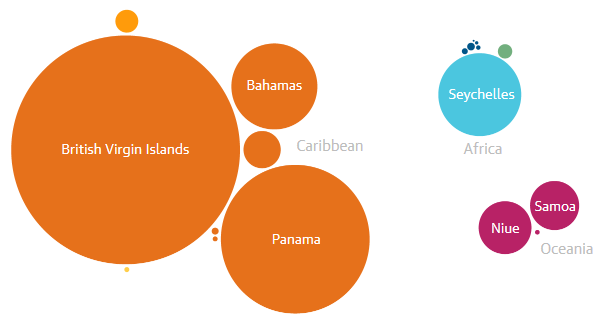

The Hiding Places

Mossack Fonseca data seen by the Guardian relates to more than 200,000 companies for which the firm acted as registered agent. Often used lawfully to anonymously hold property and bank accounts, these companies were registered in a range of tax havens, and this map shows the most popular locations among its clients. The British Virgin Islands held more than 100,000 companies.

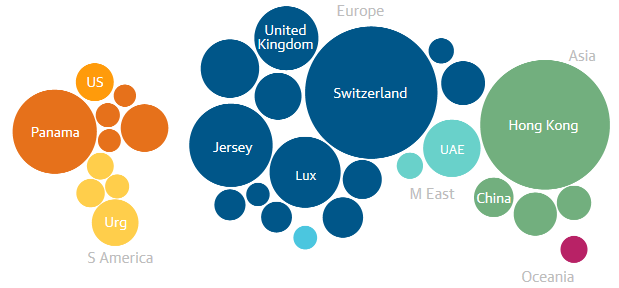

The Intermediaries

Rather than dealing directly with company owners, Mossack Fonseca mostly acted on instructions from intermediaries, usually accountants, lawyers, banks and trust companies. In Europe, these offshore facilitators are concentrated in Switzerland; Jersey, a Crown dependency of the UK; Luxembourg and the United Kingdom.

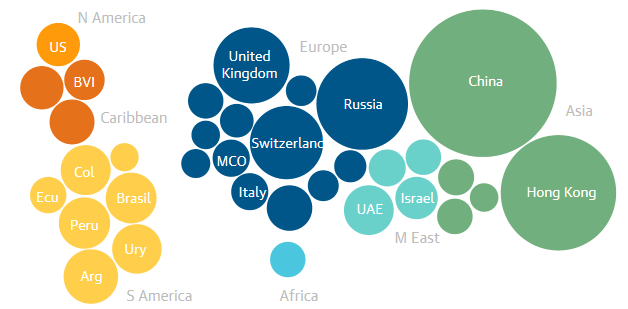

The Hidden Owners

Where does the money flowing offshore come from? The information is hard to discover because real owners usually hide behind nominees, people with no real control and no assets in the company, which simply lends its signature. A small sample of about 13,000 owners from all over the world, recently compiled by Mossack Fonseca, gives some indication. China and Russia top the list.

* Source of graphics: The Guardian

What should banks and financial institutions should be aware of?

- Shell entities

- Tax heavens

- Relatives and associates of the politically exposed persons (PEPs)

- Tycoons and famous stars, even if they were not identified as PEPs or associates.

At the time of writing, the impact of the Panama leak was not measurable. Apart from Iceland’s prime minister — who has taken a temporary leave of absence following the leak — and denial from some other officials, no formal replies have been made or actions taken. However, the Panama leaks have lifted the lid on corruption and money laundering all over the world.