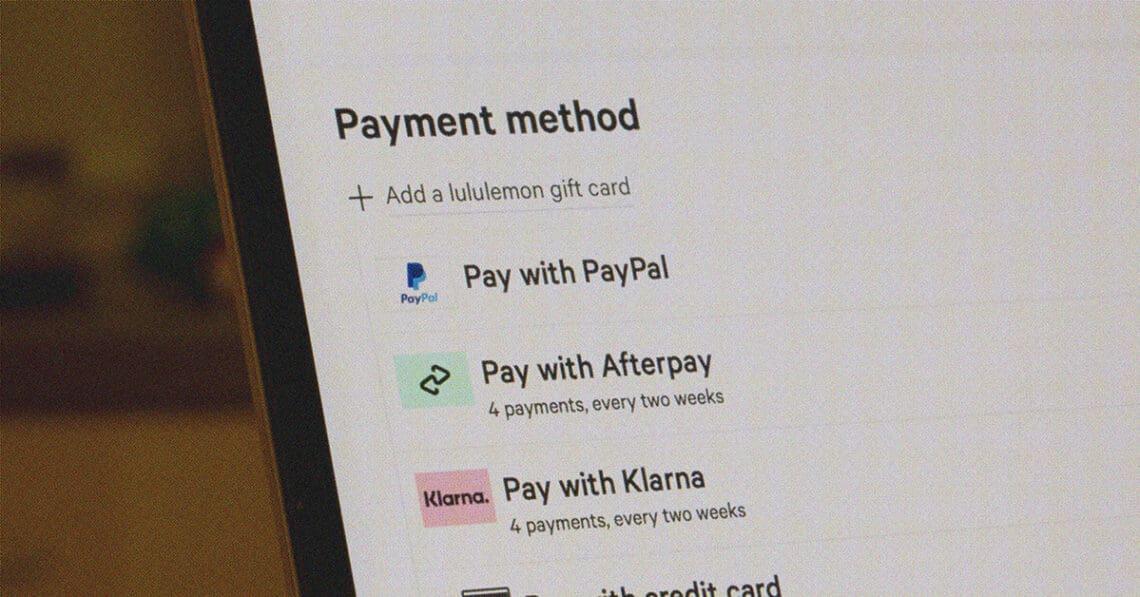

In May, the Consumer Financial Protection Bureau (CFPB) introduced a new “interpretive rule” that subjects certain short-term lenders to the same rules credit card companies follow, allowing consumers to dispute charges and receive refunds. Leo Patching, CEO of Kompliant, a banking and payments compliance provider, explores the new rule and how it will impact the Buy Now, Pay Later industry.

Since 2021, the CFPB has sought to understand the impact Buy Now, Pay Later (BNPL) lenders are having on consumers and what, if anything, the agency could do to ensure borrowers are protected. The rule it issued in May 2024 brings much-needed clarity to the growing BNPL space, an industry that will face new compliance burdens amid other sweeping regulations faced by financial institutions of all shapes and sizes.

The rule introduces several key changes for these short-term lenders. First, it emphasizes accurate reporting and proper handling of customer disputes. Lenders are now required to maintain precise records when dealing with disputes, a measure designed to prevent operational and legal complications. The CFPB has also provided guidance on what constitutes harassment or abusive practices under the Fair Debt Collection Practices Act, targeting issues like misrepresentation of debt amounts.

Another significant aspect of the rule focuses on preventing wrongful foreclosures and ensuring fair treatment of borrowers. Compliance teams will need to implement and monitor processes that adhere to these new standards, protecting both their institutions and customers. Additionally, BNPL lenders must now send consumers regular billing statements, mirroring transparency requirements long in place for credit card issuers.

The new rule provides explicit interpretations of consumer protection laws, including a clearer definition of “unfair or deceptive act or practice” under the Dodd-Frank Act. It mandates that lenders investigate disputes and halt payment requirements during these investigations. The rule also requires lenders to refund credit to consumer accounts for returned or canceled payments.

These requirements align BNPL lenders more closely with traditional credit card issuer regulations, marking a significant shift in the regulatory landscape for fintech companies. The CFPB has stated its intention to enhance enforcement measures, with the threat of legal action against violators serving as a deterrent across the financial sector.

SEC Broadens Definition of ‘Dealer’

Family offices, registered investment advisers & private funds could all be included in expanded designation

Read moreDetailsFinancial institutions are not new to facing regulatory pressures, but the recent Supreme Court opinions issued in June and July present possibilities of a reshaped regulatory landscape that will affect financial institutions in unprecedented ways. Most notably, the court struck down the Chevron doctrine, which for four decades had given agencies deference to rulemaking authority in many cases.

Given the sweeping impact of CFPB’s new rule, court challenges seem likely and could be more successful in this post-Chevron world, though the agency’s director, Rohit Chopra, said in a blog post that short-term lenders will not face penalties while they transition into compliance with the rule, so long as they do so “in a good faith and expeditious manner.” The agency also plans to issue FAQs for lenders later this month, Chopra said.

The CFPB’s interpretive rule overall underscores significant advancement in consumer protection regulation. For compliance professionals, this rule provides deeper clarity for BNPL companies and customers alike, opening space for BNPL firms to enable more effective compliance programs and better risk management strategies to not only keep pace with ongoing regulatory changes but also be proactive in protecting consumers’ rights.

As the industry digests these new rules, the implications for financial compliance teams will be far-reaching, placing operational considerations at the forefront of many organizations’ priorities.

Leo Patching is CEO and co-founder of Kompliant, a banking and payments compliance provider. He's also a board member at Falcon Fulfillment and Freetricity, where he formerly was the CEO.

Leo Patching is CEO and co-founder of Kompliant, a banking and payments compliance provider. He's also a board member at Falcon Fulfillment and Freetricity, where he formerly was the CEO.