TCS’ Ajay Katara provides insight into how banks and other financial institutions can mitigate risks stemming from climate change, discussing four building blocks for an effective risk management framework.

Climate change is a reality today. With melting ice caps and surface temperature increases, climate change continues to make its presence felt, impacting global economies. Apart from environmental aspects, one cannot neglect the financial risks that emanate from it. In this uncertain environment, banks not only have to manage their current exposures, but also transition or move to a green financing roadmap, which will greatly aid in managing climate risk.

Climate change started gaining in prominence after the 2015 Paris Climate Accord, which primarily aimed at keeping the global temperature well below 2 degrees Celsius above pre-industrial levels and also ensuring that the global financial flows work toward lower greenhouse gas emissions and climate-resilient development. However, while it continues to be one of the much-debated topics over the last few years, it has steadily emerged as a key focus area for many global banks and financial institutions.

Climate risk refers to risk emanating from global warming impacts. For banks and financial institutions, climate risk is a source of financial risk; therefore, it is a mandate of central banks and supervisors to ensure the financial system is resilient to this risk and to develop effective risk management strategies across the risk value chain, including its identification, assessment, monitoring and disclosure. Climate risk is broadly divided in to two categories, namely:

Physical risk, which emanates from climate and weather-related change events, such as floods, heatwaves, storms and sea level rise, which potentially result in large financial losses, impairing asset values and the creditworthiness of borrowers. For example, if climate change starts resulting in frequent floods in a particular region, the harsh weather will begin to impact the collateral value of the residential and commercial properties pledged for loans and will result in an increased loss given default if the customers are unable to repay.

Transition risk, which occurs from the process of moving toward a low-carbon economy. Changes in policies, technology and laws related to climate change can result in assessment changes for assets and liabilities held, which in turn alters the risk profile of the institution. For example, if the government policies change in line with the Paris Accord, then there will be a lot of reduction in fossil fuel usage, which will eventually impact the value of investments held by banks and insurance companies in sectors like coal and oil and gas.

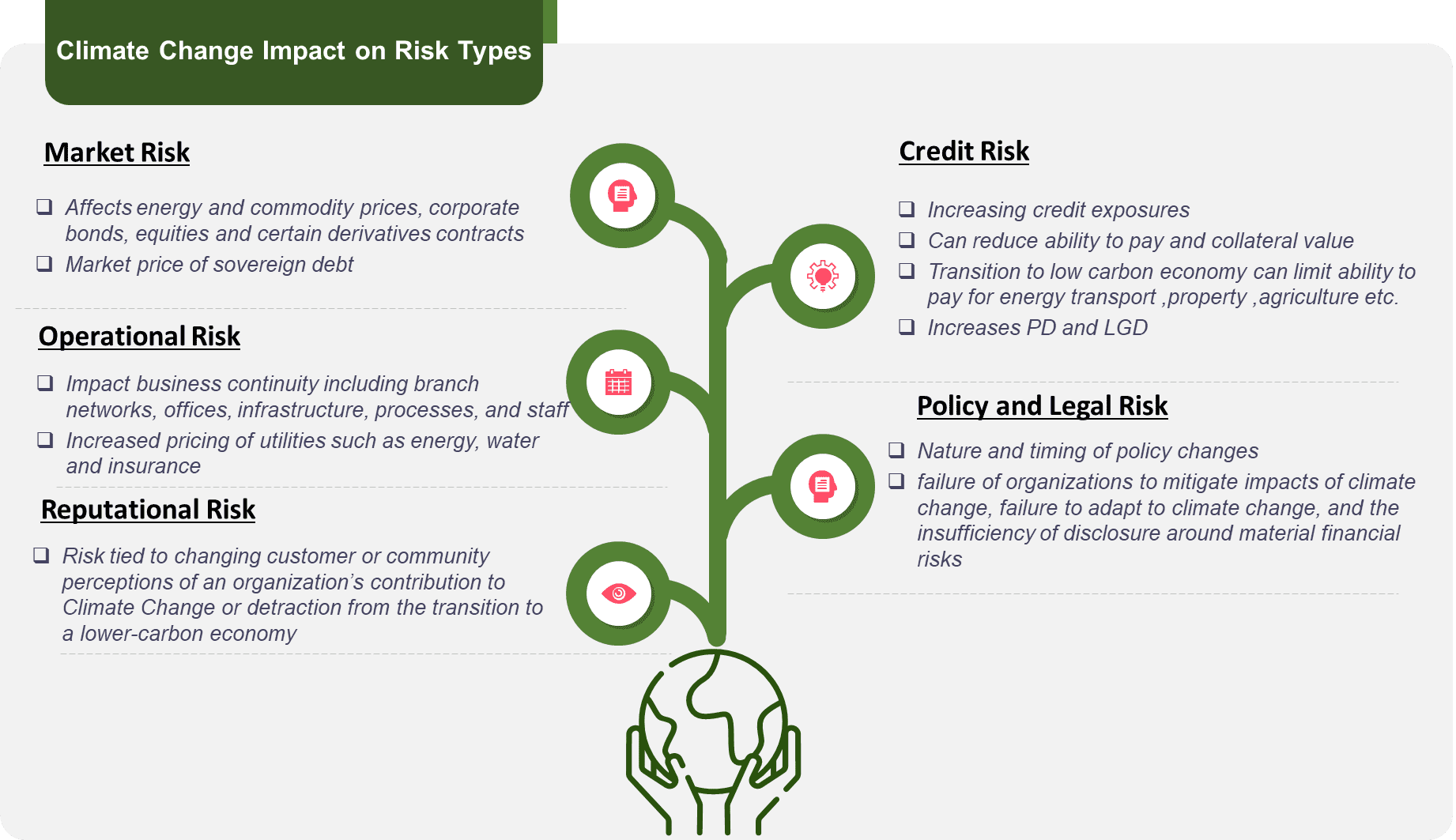

Each of the above-mentioned climate risk types has an impact on banks and financial institutions and manifests itself in one the following risks:

While climate change will bring about a host of risks, it will also put forth a lot of opportunities for banks and financial institutions. Transition to a low-carbon economy will result in reallocation of investments, and opportunities will arise in the areas of financing energy-efficient initiatives, investments supporting green technology, funding access and investments in green bonds.

While climate change will bring about a host of risks, it will also put forth a lot of opportunities for banks and financial institutions. Transition to a low-carbon economy will result in reallocation of investments, and opportunities will arise in the areas of financing energy-efficient initiatives, investments supporting green technology, funding access and investments in green bonds.

To embark on effective management, organizations will need to establish an enterprise-level vision that drives the climate focus across all departments. It will also warrant a need to establish a robust and a dynamic framework comprised of the following building blocks:

1. Establish Policy and Governance

Banks will need to establish a strong governance structure for identifying and managing climate-related risk. They will need to understand financial risks from climate change and incorporate that understanding into the overall business strategy and risk appetite statement. Definition of key metrics measuring climate change, thresholds and permissible risk exposure limits will also form a part of this statement. In short, an effective policy will need to embed the culture of climate change in the day-to-day operations.

2. Climate Risk Assessment and Controls

Banks will need to enhance their existing risk management frameworks to include aspects around climate change. For instance, the existing credit risk framework will need to be enhanced to include areas that may be impacted by climate change, like underwriting policies, risk-scoring policies, etc. A prudent mechanism will need to be established to identify, monitor, manage and report climate risk, along with the required qualitative commentary and quantitative metrics. Banks will also need to create a mechanism for the periodic assessment of material exposures impacted by climate change and to come up with strategies to mitigate them.

3. Scenarios Analysis and Stress Testing

Apart from regulatory climate change scenarios, banks will need to establish idiosyncratic scenarios and conduct stress testing exercises to measure resilience and vulnerabilities with respect to climate change. They will also need to conduct long-term assessments based on forecasts to aid in strategic planning and decision-making.

4. Active Disclosures

Successful management of climate change can be made possible through real-time monitoring of climate risk. In order to achieve this, banks will need to create insightful periodic disclosures as per the requirements of internal and regulatory stakeholders. An active disclosure mechanism can provide necessary alerts to the management to formulate policies and strategy toward effective climate risk management.

Post the Paris Accord (2015), there have been a slew of efforts from various regulatory bodies to improve understanding and adoption of climate risk management in banks and financial institutions. Efforts from varied bodies (quoting a few) like Network for Greening the Financial System (NGFS), PRA and TCFD Framework (Task Force on Climate-Related Financial Disclosures) have laid a good foundation for the effective management of climate risk. Going forward in the post-pandemic world, the efforts will need to be twofold: from the banks themselves to create a robust climate-change framework suiting their business strategy and from the global regulatory bodies who will need to define climate-risk guidelines for their specific geographies, which will eventually bring climate risk into the mainstream, with other risk types.

Ajay Katara is a Domain Consultant with the Banking Industry Advisory Group at Tata Consultancy Services (TCS). He currently heads the Solution and Strategy for Enterprise Risk and Compliance Regulations. Ajay has extensive experience of more than 15 years in the Consulting & Solution design space cutting across CCAR Consulting, AML, Basel II implementation and credit risk, and he has worked with several financial enterprises across geographies. He has significantly contributed to the conceptualization of strategic offerings in the risk management space and has been instrumental in successfully driving various consulting engagements. He has also authored many editorials, details of which can be found on his

Ajay Katara is a Domain Consultant with the Banking Industry Advisory Group at Tata Consultancy Services (TCS). He currently heads the Solution and Strategy for Enterprise Risk and Compliance Regulations. Ajay has extensive experience of more than 15 years in the Consulting & Solution design space cutting across CCAR Consulting, AML, Basel II implementation and credit risk, and he has worked with several financial enterprises across geographies. He has significantly contributed to the conceptualization of strategic offerings in the risk management space and has been instrumental in successfully driving various consulting engagements. He has also authored many editorials, details of which can be found on his