As pay transparency laws have proliferated at the state and local level, so have mentions of expected salaries in job postings — but so have class-action lawsuits. Jessie Lenhardt of accounting and consulting firm Moss Adams explores the details of the most prominent state transparency laws, the California Pay Transparency Act.

Pay transparency laws have gained momentum in recent years as governments and advocates push for greater equity and fairness in the workplace. These laws aim to promote transparency around compensation practices, prevent pay discrimination and empower employees to have open discussions about their wages.

Jurisdictions around the world, including within the U.S., have implemented various pay transparency laws, each with its own requirements and implications for employers. Eight states and a handful of municipalities have put in place pay transparency laws, with California’s being perhaps the most prominent. The California Pay Transparency Act, also known as Senate Bill (SB) 1162, went into effect Jan. 1, 2023, adding new payroll, hiring and reporting requirements for organizations with at least 15 employees.

What is SB 1162?

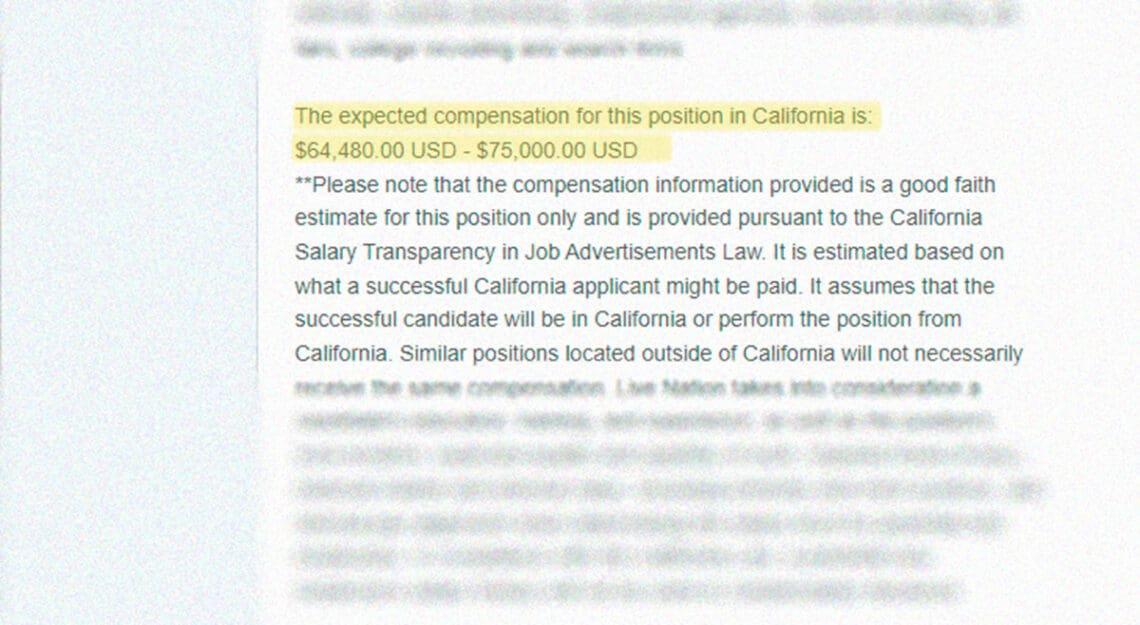

The California Pay Transparency Act is a significant development in promoting pay transparency in the state and is applicable to both applicants and employees. It expands on the concept of pay transparency by requiring employers to include pay ranges in job descriptions and make them available to employees upon request. The act defines pay scale as the salary or hourly wage range that an employer reasonably expects to pay for a specific position.

What changed under SB 1162?

There are two significant changes related to pay transparency — reporting and notification requirements.

Reporting pay data

SB 1162 expands pay reporting obligations by requiring employers with 100 or more employees to submit annual pay data reports to the California Department of Fair Employment and Housing (DFEH). These reports must include the mean and median hourly wage rates for each combination of race, ethnicity and sex within each job category. The deadline for filing these reports has been moved to the second Wednesday of May.

Pay notification requirements

SB 1162 also introduces pay notification requirements, mandating that employers with 15 or more employees include the pay scale for a position in any job posting. Employers must also provide the pay scale, upon request, to current employees for their current position. Additionally, employers are required to maintain records of job title and wage rate history for each employee for the duration of employment plus three years after employment ends.

Pay Transparency — It’s Not Just Good for Workers

As more cities and states adopt laws mandating a degree of salary transparency, companies may face a regulatory patchwork to contend with. But ADP’s Helen Almeida believes being open about compensation is good — for businesses and the workforce.

Read moreDetailsLabor contractor vs. labor contractor employee

It’s important to understand the distinction between a labor contractor and a labor contractor employee. This will help organizations accurately identify and report labor contractor employees to remain compliant with SB 1162.

- Labor contractor: An individual or entity that supplies workers to a client employer to perform labor within the client employer’s usual course of business.

- Labor contractor employee: An individual on a labor contractor’s payroll, including part-time individuals, who perform labor for a client employer within the client employer’s usual course of business.

Employers are required to file a labor contractor employee report with the California Civil Rights Division if they have 100 or more labor contractor employees and at least one employee in California. The report must include labor contractor employees assigned to California establishments or working within California.

How to remain compliant with SB 1162

To stay in compliance with SB 1162, organizations should consider the following:

- Review and update job descriptions. Ensure that pay ranges are included in job descriptions and that they accurately reflect the employer’s expectations for compensation.

- Provide pay scale information. Include the pay scale for a position in any job posting, both on the organization’s website and on third-party platforms.

- Respond to employee requests. When employees request pay scale information for their current position, promptly provide them with the relevant details.

- Maintain accurate records. Keep records of job titles and wage rate history for each employee throughout their employment and for three years after their employment ends.

- File pay data reports. If the organization has 100 or more employees, ensure timely filing of annual pay data reports with the California Department of Fair Employment and Housing.

Consequences of noncompliance

Employers who fail to file the required pay data reports may face penalties of $100 per employee for the initial failure and $200 per employee for subsequent failures. Violations of pay scale notification requirements may also lead to civil penalties under California’s Private Attorneys General Act (PAGA).

Failure to comply with legislation has also led to a rise in class-action lawsuits and subsequent financial penalties for employers. California has seen pay discrimination lawsuits stemming from information discovered as a result of pay transparency regulations. This illustrates the networked impact of pay transparency, equal opportunity employment, anti-retaliation and compensation equity legislation.

Regularly updating your compensation data can also help to avoid the tangential consequences of pay transparency regulations. For example, in Washington, employers are facing a dramatic rise in class-action lawsuits. Since June 2023, 31 lawsuits have been filed against companies and Washington’s Department of Labor and Industries received 224 complaints about employer noncompliance through the end of September. Each lawsuit alleges violations of pay transparency laws, centered primarily on the failure of employers to disclose wage information or salary ranges in job listings. Potential remedies include reinstatement, injunctive relief and civil monetary damages.

Lawsuits have also been filed in New York and other states, and across industries, including finance, technology and law.

As of January 2024, companies in Colorado, D.C. and Hawaii must also comply with amended pay transparency legislation. New rules go into effect in Maryland in October and several other states next year, including in Illinois, Vermont and Minnesota.

Jessie Lenhardt, PMP, is a senior manager at Moss Adams. She specializes in organizational development work including ESG strategy, strategic and succession planning, process improvement, organizational and operational assessments, compensation benchmarking and structure and staffing assessments.

Jessie Lenhardt, PMP, is a senior manager at Moss Adams. She specializes in organizational development work including ESG strategy, strategic and succession planning, process improvement, organizational and operational assessments, compensation benchmarking and structure and staffing assessments.