Stuart McLachlan and Dean Sanders, authors of “The Adventure of Sustainable Performance: Beyond ESG Compliance to Leadership in the New Era,” share their views on the fortitude required of leaders today — and tomorrow.

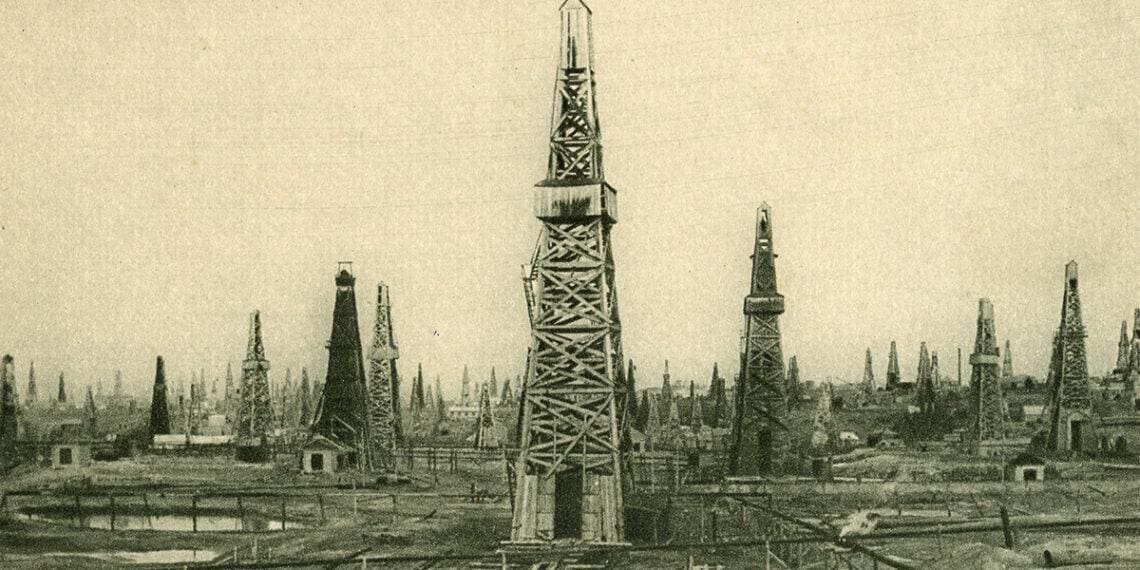

The next industrial revolution is upon us and is driven largely by the climate transition.

As business leaders, we are in a moment that presents a rapidly changing risk and opportunity landscape that needs navigating. But the seismic shifts are being measured, we have foundational truths, and against the backdrop of ever-increasing compliance requirements, such as the impending SEC climate rule later this year, we need to make some decisions.

This comes with responsibility. For many leaders, compliance represents an easier route. It’s a level playing field — you have to retain your license to operate and maintain your business as usual. Tell me what to do, legislate and we will respond, often at a pre-competitive industry level.

Compliance is necessary, but an overly myopic focus results in leaders missing the opportunity for value creation, for discovering the adventure of moving beyond the daily charge of compliance and associated reporting toward sustainable performance, which we believe will characterize a new era of business and investment. Leaders who are most likely to thrive in this space will need to be courageous and willing to step into a place of uncertainty, possible danger and adventure with the right guides alongside them.

Pivot or perish

Our message to leaders is clear. You have to move. The liminal space that you find yourself in is real. Transformational change is inevitable, and if you don’t respond to the imminent danger, then the organization that you lead will likely perish.

Typical business models and value chains reflect prevailing norms, often with a leadership focus that is self-serving and where strong values are left at the door. As a result, many businesses and business models have become fortresses that must be defended at all costs, and board directors, guided by audit and risk management controls, are encouraged to fortify legacy structures as their fiduciary duty.

In “The Adventure of Sustainable Performance” we, and the business leaders we interviewed, are convinced that in this age of disruption, business enterprises will redefine value and create new value for all stakeholders. Leaders heading for a new era of business enterprise will need to embrace the reality of adventure and leaving business as usual behind.

By “sustainable performance” we mean a way of operating that unlocks value creation advantages by placing the organization in the service of an environmentally sustainable and socially just future. By reaching out into the world, being curious about how it works and finding challenges to address and opportunities to seize, boards will drive the sustainable performance of their organizations.

We Still Haven’t Seen the SEC’s Final Disclosure Rules, But We Already Know the Impact Won’t Be Equal

SEC regulations on what companies must report regarding their environmental impact are expected this year. While large firms and those in high-carbon industries have already started disclosing some of this information, as FTI Consulting’s Ben Herskowitz and Todd Rahn discuss, both size and sector play a role in firms’ climate disclosure program maturity.

Read moreDetailsMalleable capitalism

Sustainable performance includes a shift in capital performance. We see capitalism as an economic model that will transcend eras, but we recognise how it can become a wild beast. Capitalism has been proven to be malleable to the prevailing culture of the day, or of the nation, the city, sector or company. The concept of stakeholder capitalism is straightforward. Companies should make money and use this wealth creation to generate returns for shareholders, tackle inequality and regenerate and protect our natural assets. They do this by engaging the stakeholders in the value chain to generate value and then to distribute this value across all the stakeholder groups that are relevant to the entire value chain of the business.

Stakeholder capitalism offers some fundamental but subtle differences from the neo-classical models of capitalism that form the narrative of the practice of capitalism that was dominant until now. For example, the prevailing idea was that corporations shouldn’t carry a position of social responsibility and that only individuals or the public sector should carry this responsibility. You try telling that to the average CEO who is striving to navigate their corporate positioning around institutional racism, DEI and climate change, with the consequences of getting it wrong including loss of talent, destruction of brand value and being alienated from certain market and investment sectors.

Stakeholder capitalism is capitalism that can’t be segregated from the environment and from society, that operates in a network and that gives recognition to the opportunities to make a positive impact in a wider ecosystem.

Richard Mattison, president of Sustainable1 at S&P Global, told us of the need for a vast increase in the allocation of financial investment toward sustainability, amounting to trillions of dollars to ensure that global sustainable development and climate goals are to be met, particularly in developing markets. For Mattison the narrative “is about growth, as well as mitigating risk,” something that is often missed. S&P plays into this narrative by providing “objective and independent intelligence to allow investors and banks and other allocators of capital to make better and more effective decisions,” to better understand “the risks associated with any particular investment.” Critically, this knowledge is now impacting corporate and infrastructure credit ratings.

Investment in sustainability as a new business opportunity

Facing the reality of this revolution now will take us as leaders into the liminal transition zone. This will feel dangerous, but it will provide the opportunity for transition into the hydrogen economy, carbon capture and the production of bioplastics, low-carbon fertilizers and biofuels and to participate in the next industrial revolution, possibly even clean energy.

Decarbonizing your operations, moving from linear to circular, becoming inclusive and transparent in the way you conduct your operations and embracing stakeholders who have previously been outside your value chain is complex. This will not be a linear transition that aligns with the process-driven, highly structured approach of the average strategy consultant or behavior change expert seeking incremental nudges in improvement. This will be a root-and-branch reform on how you thrive in a non-linear model.

Boards can create value as an outcome of the purposeful and impact-driven way they found and guide their enterprises, and they will understand the inputs and outputs to value creation differently. In talking with Guillaume Le Cunff, CEO of Nespresso, about “The Adventure of Sustainable Performance,” he framed it this way: “At Nespresso we want to make each cost of compliance an investment in potential value creation. And we want to make each investment in sustainability a new business opportunity.”

This revolution is not happening in a sequential or rational way. We emphasize this point as the world needs adaptive leaders who are dynamic enough to seek catalytic sources of activation, operating in a complex system that is non-linear and where courageous decisions are made at a frontier that is defined by truth.

Stuart McLachlan

Stuart McLachlan  Dean Sanders

Dean Sanders