Forward-looking companies aren’t waiting for taxes and regulations to balance the greenhouse gas emissions of their supply chains. They’re taking advantage of decarbonization incentives. These carrots can lessen the balance sheet impact involved with making operations more efficient and less reliant on carbon.

As customers, investors and regulators continue to pay close attention to corporate measures taken to combat climate change, environmental, social and governance (ESG) principles have come to the forefront of business and investment decisions. Governments also play a key role as many have recently introduced regulations in an effort to reduce greenhouse emissions and create a more sustainable community. As a result, companies must be proactive in reducing their emissions and addressing a wide range of ESG issues across the value chain. This has led to the embedding of ESG in all aspects of a business, from investment decisions and capital allocations to supply chains and operations, from talent and diversity to policies and reporting.

While consumer and investor demands are prompting many companies to reduce their supply-chain emissions, governments around the world increasingly rely on taxes, incentives and regulations to influence corporate behavior around ESG and promote emission reductions. These environmental taxes and regulations can increase costs for companies and their suppliers, but incentives can help companies defray the cost of reducing their emissions footprint. Companies must implement a flexible, forward-looking ESG tax strategy to ensure they are increasing their cost savings through incentives while also reducing their overall environmental tax liability.

Supply Chains Are the Most Significant Source of Emissions Across the Value Chain

Globally, supply chains are responsible for approximately 80% of greenhouse gas emissions. Of more than 2,000 CEOs surveyed in the 2022 EY Global CEO Outlook Survey, over 50% plan on prioritizing sustainability in 2022. These forward-thinking corporations are taking steps towards a sustainable future by using technological efficiencies to reduce energy demand, shifting their energy portfolio to rely more heavily on renewables, and developing strategies to reduce emissions throughout their supply chain, including both upstream and downstream emissions.

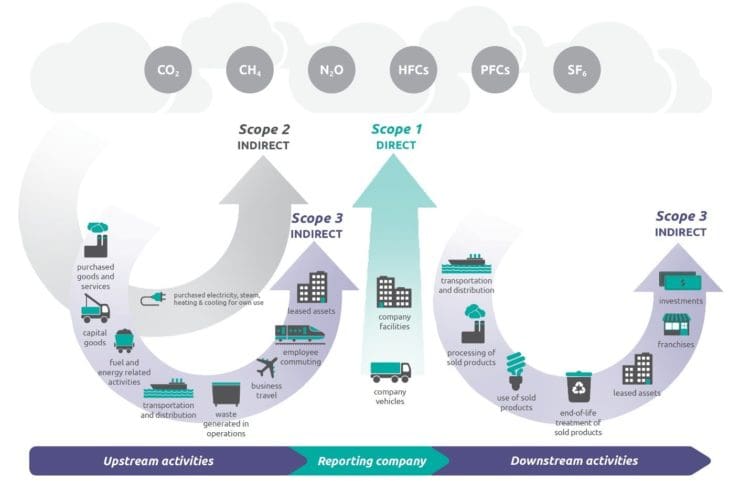

Historically, corporations have focused first on reducing their Scope 2 (indirect) emissions by procuring green energy and/or making energy-efficiency upgrades to reduce the amount of energy purchased. Many companies have also emphasized reductions in Scope 1 (direct) emissions, such as those from company facilities, fleet vehicles or other assets owned/controlled by the company. Reductions in these direct emissions have been accomplished by installing renewable energy systems, replacing old, high-polluting vehicles with new cleaner alternatives and improving the manufacturing process.

Most current environmental taxes and regulations focus solely on these Scope 1 and 2 emissions. Additionally, many companies adhere to reporting regimes that require them to report their Scope 1 and 2 emissions annually. This has helped to accelerate decreases in these emissions as companies evaluate their current emissions footprint and invest in emissions-reducing technologies, as well as power-purchase agreements for renewable energy.

A third group of emissions (Scope 3 emissions), however, is far more complicated to address as it includes all indirect emissions that occur in a company’s value chain, except those related to the purchase of energy. Supply-chain emissions make up a large proportion of Scope 3 and are undeniably complex and interrelated. While diesel combustion from company vehicles and electricity usage in offices are obvious sources of supply-chain externalities, employee commutes and the treatment of products at the end of their lifecycle are less tangible for most businesses. But companies that are poised to create a truly net-zero supply chain must target all three emission types.

Taxes, Regulations and Incentives Play an Increasingly Important Role in Supply-Chain Decisions

There are currently more than 4,000 environmental taxes globally. Environmental taxes raise the cost of emissions, manufacturing, transportation, energy generation, resource use and other negative environmental externalities associated with most businesses and their suppliers. The European Union (EU), for example, recently adopted the Carbon Border Adjustment Mechanism (CBAM) in addition to the existing EU Emissions Trading Scheme. The carbon-pricing system would increase the price of certain carbon-intensive imports to prevent carbon leakage outside of the EU. CBAM currently applies to direct emissions generated throughout the value chain, but the European Commission intends to consider extending the scope of CBAM to include indirect emissions soon.

Similarly, countries like Canada, China and South Africa have carbon markets that set caps on emissions and require major emitters to trade carbon credits. While the majority of the current tax regimes focus on reducing carbon emissions, the tax landscape is becoming increasingly complex with the introduction of new taxes targeting waste reduction and product reuse, such as plastics taxes, which have been introduced in several jurisdictions. These taxes impose a major financial burden on businesses of all sizes, regardless of revenue or jurisdiction. As such, environmental tax liabilities must be addressed by identifying and capturing applicable tax incentives.

Environmental Tax Incentives Are an Extremely Cost-Effective Tool to Decarbonize All Stages of a Company’s Supply Chain

Most developed countries offer a myriad of incentives to encourage “green” activity. Over 3,700 incentive programs for “green” investments or activities exist today. Companies are using tax credits and incentives to accelerate investment in clean technologies and help their businesses develop greener operating procedures, particularly in the industrial manufacturing, utility and commercial sectors. While these incentives vary by jurisdiction, they can often be leveraged for a wide range of investments from electric vehicles to installing renewable energy systems.

Tax incentives relating to GHG emissions, energy consumption and production, and waste are abundant in most countries, but too few companies consider, let alone prioritize, capturing these benefits. For example, the U.S. government has awarded billions in incentives to manufacturers that produce emissions-reduction technologies or re-equip their manufacturing facilities to be more energy efficient in an effort to reduce upstream emissions. The United States also offers an investment tax credit of up to 30% of the cost of installing clean energy technologies, like solar, wind, geothermal, fuel cell and cogeneration.

Indirect emissions are also captured to some extent in today’s tax incentive landscape. Certain states, like Nevada and Maryland, offer state-level property tax abatements of up to 35% for 10 years for certified green buildings. Corporations investing in new construction or renovations can certify offices and commercial facilities through rating systems like LEED (Leadership in Energy and Environmental Design) and Green Globes. Incentives can also be leveraged for investments in supply-chain activities that generate the most dispersed Scope 3 emissions, like transportation, distribution and commuting.

Companies may also be able to use incentives for projects that reduce waste from operations and manufacturing and/or at the end of the products’ lifecycle. These projects often include either the use of recycled material in a company’s products and ensuring that the product, or at least a portion thereof, is recyclable at end of life. The recently enacted Infrastructure Investment and Jobs Act (IIJA) includes over $375 million in funding for recycling programs. Of this funding, $25 million will be invested in demonstration grants to develop innovative technologies for battery recycling. Companies may also look to use waste streams as feedstock to produce energy through biomass systems, which are renewable energy systems that are often eligible for Federal tax credits under Section 45 and Section 48.

While these tax incentives can be applied to in-house supply-chain phases quite easily, many corporations outsource elements of their supply chain. Even with no direct control of a third-party supplier, however, corporations can still develop strategies that encourage decarbonization, with incentives playing a critical role in these strategies. Supply-chain leaders work closely with their upstream and downstream suppliers to analyze their sustainability metrics and encourage emissions reporting. Educating existing suppliers on the various emission types and available tax incentives can help to reduce their GHG emissions and costs. Additionally, companies can implement programs or technologies to help supply-chain partners identify incentives that may be available as they implement sustainability initiatives. When considering new supply-chain partners, companies should consider emissions standards in process. With such a large majority of GHG emissions coming from the supply chain, decarbonizing every phase is crucial to achieving material reductions.

Forward-Thinking Businesses Must Take a Proactive, Incentive-Centric Approach to Supply-Chain

The public and private pressure on companies to implement an effective ESG strategy is too great to ignore. The best practice for any forward-thinking business is to take a more inclusive, tax-centric approach to supply-chain decarbonization. Proper communication among the C-suite, operations, and Tax will ensure comprehensive tax planning, continuous monitoring of proposed legislation and regulations affecting corporate carbon footprints, and effective identification and capture of tax incentives. Funding through green financing instruments and tax equity should be coupled with thorough environmental tax compliance and reporting to manage risk and make day-to-day operations more resilient, even amid the Covid-19 pandemic. The breadth of supply-chain decarbonization highlights the value of tax planning and compliance services related to sustainability. Supply-chain leaders that best manage their supply-chain emissions and improve savings through effective tax approach, empowering the economic business case, may be the ones who reach their emissions goals fastest while realizing the greatest return on investment and best operational outcomes.

Cate Mork also contributed to this article.

Paul Naumoff is a principal and global location investment services, credits and incentives leader at EY. He has 25 years of location advisory and federal, state and local credits and incentives experience. Paul leads a network of over 300 location investment advisory, business incentives and credits professionals whose global, federal, state and local business incentives knowledge comes from their collective experience on more than 1,000 economic development engagements.

Paul Naumoff is a principal and global location investment services, credits and incentives leader at EY. He has 25 years of location advisory and federal, state and local credits and incentives experience. Paul leads a network of over 300 location investment advisory, business incentives and credits professionals whose global, federal, state and local business incentives knowledge comes from their collective experience on more than 1,000 economic development engagements. Akshay Honnatti is a senior manager in the Sustainability Tax Services practice and is based in San Francisco, California. Akshay specializes in business incentives and credits for sustainability initiatives. His experience includes conducting 179D (EPAct 2005) analyses for energy efficient commercial buildings, assisting with tax credits for renewable energy projects, and securing grants for sustainability investments. He has also worked with clients to help analyze the business impact of carbon taxes or cap-and-trade mechanisms across the world. Prior to joining EY, Akshay worked briefly with a global industrial and manufacturing company in their Center for Energy Efficiency and Sustainability. He was part of the Environmental Defense Fund’s Climate Corps Program and led the firm’s efforts in developing an energy audit program and conducting audits at several facilities to identify and analyze energy efficiency opportunities.

Akshay Honnatti is a senior manager in the Sustainability Tax Services practice and is based in San Francisco, California. Akshay specializes in business incentives and credits for sustainability initiatives. His experience includes conducting 179D (EPAct 2005) analyses for energy efficient commercial buildings, assisting with tax credits for renewable energy projects, and securing grants for sustainability investments. He has also worked with clients to help analyze the business impact of carbon taxes or cap-and-trade mechanisms across the world. Prior to joining EY, Akshay worked briefly with a global industrial and manufacturing company in their Center for Energy Efficiency and Sustainability. He was part of the Environmental Defense Fund’s Climate Corps Program and led the firm’s efforts in developing an energy audit program and conducting audits at several facilities to identify and analyze energy efficiency opportunities. David Camerucci is a manager in EY’s Sustainability Tax Services practice with extensive experience in the sustainability tax and incentives space. David has assisted clients in capturing millions of dollars in credits and incentives for sustainability-related investments ranging from fleet and supply chain decarbonization to the installation of complex renewable energy systems. David works closely with both public and private sector organizations to navigate the complex sustainability tax and incentives landscape, and to secure various federal, state, local and private-sector incentives for their investments.

David Camerucci is a manager in EY’s Sustainability Tax Services practice with extensive experience in the sustainability tax and incentives space. David has assisted clients in capturing millions of dollars in credits and incentives for sustainability-related investments ranging from fleet and supply chain decarbonization to the installation of complex renewable energy systems. David works closely with both public and private sector organizations to navigate the complex sustainability tax and incentives landscape, and to secure various federal, state, local and private-sector incentives for their investments.