SEC regulations on what companies must report regarding their environmental impact are expected this year. While large firms and those in high-carbon industries have already started disclosing some of this information, as FTI Consulting’s Ben Herskowitz and Todd Rahn discuss, both size and sector play a role in firms’ climate disclosure program maturity.

Climate change has increasingly become a major focus for regulators, investors and companies worldwide, with the Task Force on Climate-Related Disclosures (TCFD) at the forefront of this push. As the effects of climate change continue to unfold, executives and boards are becoming more conscious of potential climate-related business impacts.

The landscape around ESG disclosures is shifting in ways that will affect corporate America for years to come. Already, proposed regulations around climate disclosures pose myriad implications for publicly traded companies, some of which may struggle to comply. In particular, companies in certain sectors and those in the small-to-midcap range may face a steep learning curve.

Not Sure What ESG Metrics to Report? Take a Page From the S&P 50

Despite a lack of regulatory clarity in the U.S. on ESG reporting, companies are barreling ahead with disclosing a variety of related metrics.

Read moreDetailsIn February 2021, the SEC announced that it would focus on reviewing climate-related disclosures among public companies. The following year, it proposed regulations that would require public companies to disclose information on their greenhouse gas emissions (GHG) and climate-related risks by 2024 and require companies to disclose their exposure to climate risks and their efforts to mitigate those risks in line with the TCFD’s recommendations.

This comes at a time of growing interest among investors and major institutions. Many observers expect the proposed rules to become final this year, as early as spring.

Regardless of the SEC’s timeline (or possible scaling-back of its proposed rules), competition to secure global capital from investors who increasingly integrate climate-related information into investment analyses, along with mandatory climate reporting in other jurisdictions and regions, are already putting pressure on U.S. companies.

Those who make relevant preparations are likely to benefit reputationally and financially. But this will be easier said than done depending on size and industry, among other factors.

Uneven disclosure across industries and market capitalizations

Although companies in traditionally more carbon-intensive industries (e.g., energy and construction) have been more proactive in making climate-related disclosures, companies in less carbon-intensive sectors like healthcare and technology have lagged. According to the SEC, between June 2019 and December 2020, the industries with the fewest climate-related disclosures in their filings were:

- Interactive media and services

- Chemicals

- Banking

- Consumer retailing

- Textiles and apparel

Companies in these sectors may have to put major effort into catching up if the SEC begins mandating climate disclosures. The SEC estimates that complying will add more than 26,200 hours of accounting for so-called “smaller reporting companies” (SRCs) and almost 30,500 hours for non-SRCs. Companies from underreporting sectors comprise significant portions of the Russell 3000 index — healthcare, for example, makes up around 13% of the index. In the Russell 1000, where the average market capitalization is higher, 50% of companies made two or fewer environmental disclosures in 2022.

Small-cap and mid-cap companies face unique challenges when it comes to disclosing ESG information and preparedness, as their limited size may mean they lack the necessary resources to meet reporting guidelines. The Conference Board, a New York-based global think tank, noted in 2022 that while more than half of companies in the S&P 500 disclosed their greenhouse gas emissions, less than a third of the S&P Midcap 400 did. Similarly, Moody’s Analytics has noted that alignment with the TCFD’s recommendations varies by sector and firm size, with larger companies more likely to comply in the U.S. and Europe.

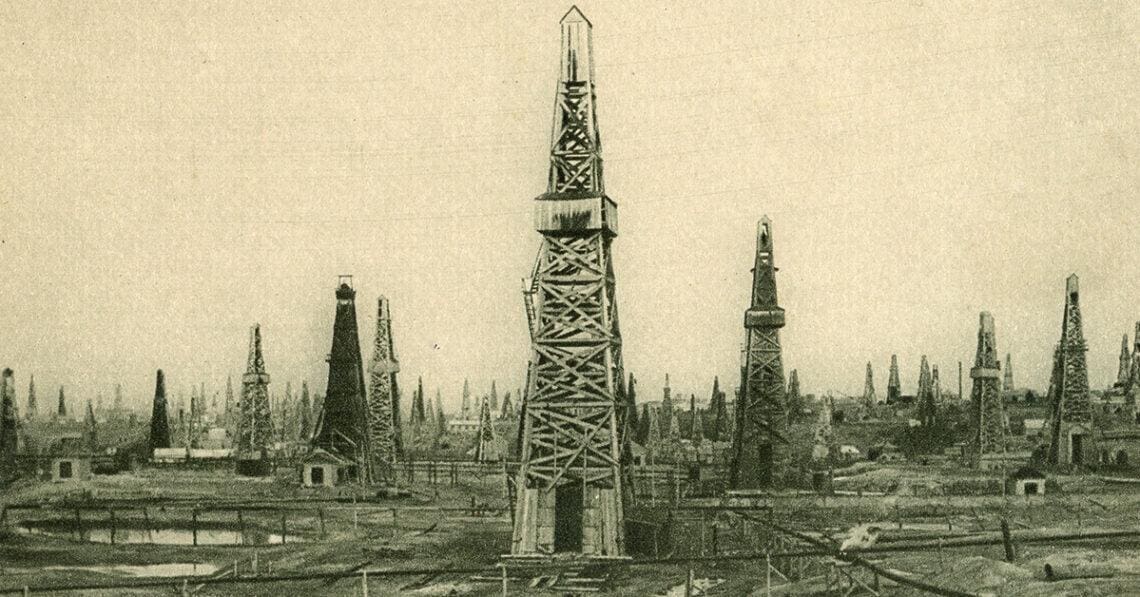

Evolving perspectives around ESG have driven discrepancies in disclosure between sectors. As corporations and the wider society become more aware of the impact that companies’ operations have on the environment, focus is growing on their emissions and supply chains. Historically, however, companies in the energy sector have attracted the bulk of concern due to the carbon-intensive nature of their activities and have thus been more likely to report on climate risk in their operations.

Sectors continue to be judged differently around ESG, which encompasses a wide variety of metrics ranging from community relations to business ethics. The weight of environmental considerations in MSCI’s ESG ratings for healthcare technology and apparel retail companies, for instance, are dwarfed by the oil and gas drilling sector, where environmental impact accounts for nearly half of that sector’s ESG rating (40.5% vs. 5.5% and 15.2%, respectively).

While environmental risks affect oil and gas drilling companies the most, healthcare technology and apparel retail companies are exposed to social risks, including labor management and privacy and data security issues. Variance in how companies’ ESG efforts are judged mean that specific companies and sectors have not yet had more of an incentive to disclose risks in certain areas than others. Thus, they may be less prepared to comply with the SEC’s upcoming regulations.

Going forward, proposed climate disclosure regulations could prove the tip of the iceberg. The SEC has indicated that it is considering expanding its disclosure rules to cover other aspects of ESG reporting, which would further pressure companies to prioritize such considerations. As the impacts of climate change become more evident, regulators may also take more aggressive action to require companies to further disclose their exposure to climate risks and their efforts to mitigate those risks — with investors likely to keep an eye out as well. Improved ESG reporting will have the potential to help companies identify and mitigate risks, enhance long-term value creation and build trust with stakeholders.

Steps companies can take right now

Whether a company is looking to comply with the law, attract climate-conscious investors or respond to the concerns of other stakeholders, the proposed SEC regulations offer a framework for taking action.

With an understanding that companies have limited resources and may have expertise gaps as it relates to full and effective compliance with the SEC’s proposed climate regulation, they should perform a robust analysis of potentially material climate-related risks and opportunities — both on direct operations and the value chain.

To institute effective governance, controls and risk management processes, companies must first perform a detailed analysis of potentially material climate-related risks. Only once the probability, magnitude, timing and potential financial impact of climate-related risks and opportunities have been assessed can companies confidently make critical business decisions, such as determining appropriate metrics and targets and developing mitigation strategies.

After assessing the potentially material climate-related risks and opportunities under relevant climate scenarios, we recommend companies take the following steps as they seek to comply with potential climate reporting mandates:

- Identify and engage with key stakeholders and decision-makers charged with responsibility and ownership of the climate-related disclosure and communications processes

- Inventory current-state climate-related reporting and align it with overall ESG and climate disclosure strategy.

- Implement clear policies, processes and controls for identifying and reporting climate-related information, including risks and opportunities, financial statement impacts.

- Develop processes and controls to identify and measure emissions within upstream and downstream value chains, including key systems and sources of data.

- Engage early with advisors and external auditors to identify and capitalize on potential benefits and to minimize disruptive impacts on the organization.

The road ahead

Regardless of what the SEC’s final disclosure requirements say or when they are released, the importance of climate-related and other ESG disclosures is growing. Investors, customers, employees and other stakeholders are demanding greater transparency and accountability. Other jurisdictions are increasingly focused on such reporting; their disclosure regimes increasingly apply to U.S. companies as a result of doing business in a globally connected world.

Companies that fail to meet these expectations domestically and abroad set the stage for reputational damage and lost opportunity. Companies that are slow to adapt to new reporting requirements may face increased scrutiny from investors and regulators and encounter more barriers to accessing capital markets.

The current moment represents a significant opportunity for small-cap and mid-cap companies to catch up to their large-cap counterparts in terms of ESG disclosure and preparedness. By taking proactive steps to identify and disclose climate-related risks, these companies can position themselves for long-term success. In prioritizing ESG considerations, companies will also find opportunities to enhance their risk management processes and improve operational efficiencies and long-term financial stability.

Ben Herskowitz

Ben Herskowitz Todd Rahn

Todd Rahn