with co-author Joseph Duerr

Company management and shareholder activists have the same goal in theory: to maximize long-term value. A stronger and more valuable company not only benefits its shareholders financially, but lays the economic foundation for the company to serve the interests of other stakeholders, including customers, employees, suppliers and its community. But while some activists share these long-term objectives, others are narrowly focused on pushing share prices higher in the short term by reducing costs, increasing leverage and selling assets.

The reality is that in many instances, although activist investors are successful at improving margins, they struggle to drive growth. We analyzed companies in which an outside activist has had a significant impact on the company’s strategy over the past 10 years and found that while a little more than half of these companies improved margins more than their non-activated peers after three years of being activated, only 18 percent were able to grow revenue faster than non-activated peers over the same time period. Growth is important for long-term value because when you break apart an average company’s stock price in the S&P 500, we find that one-third of the value of the company is driven by future profitable growth. So short-term activism that focuses only on imminent margin improvement is missing a large part of what drives long-term shareholder returns.

And yet management often has difficulty responding to specific activists. To respond more effectively and increase the chances of boosting long-term value, management should develop a more effective shareholder value plan before being approached by an activist. Senior managers can do so by making use of their chief advantage: information.

As insiders, senior managers have access to a deep and granular understanding of the company’s operations, customers, markets and competitors. Because they know how the business works, they can determine which customers, geographies and business lines are creating value for the company, which are consuming it and where profit pools exist in the market. They can translate this information advantage into a performance advantage by developing new strategies to capture a greater share of these profit pools and by making better resource allocation decisions. Managers should follow a three-step approach:

Step 1: Evaluate Where the Opportunities for Value Creation Exist

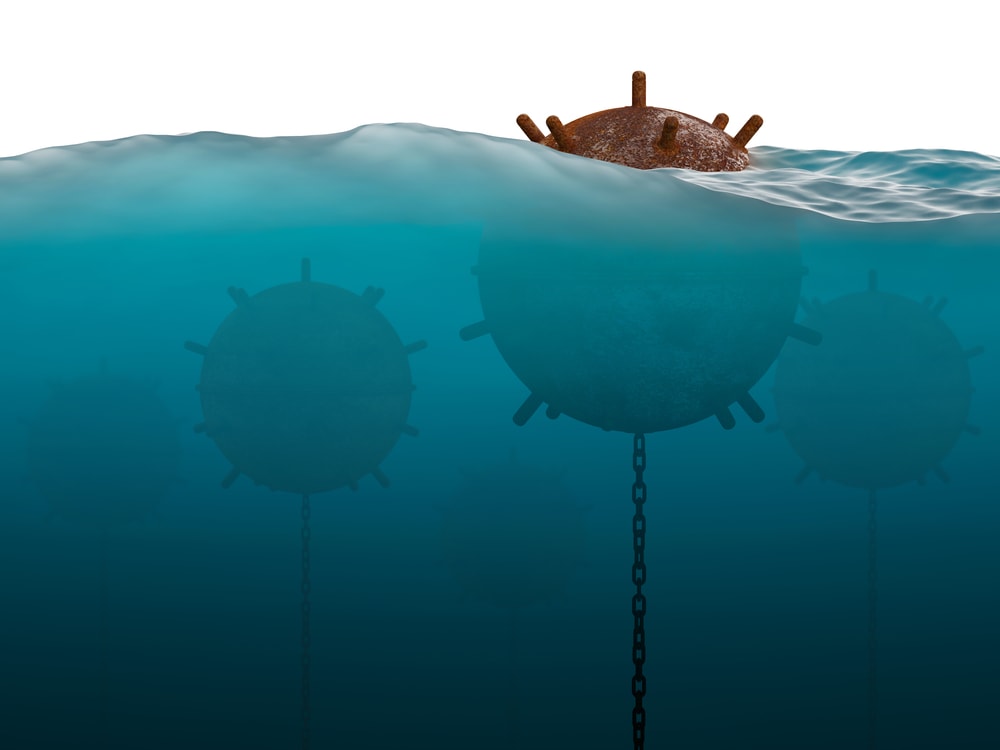

Value is always highly concentrated within a business — by company attribute, segment, product, customer and geography — often to a degree not evident on the surface. Despite the wealth of disclosures that companies make in regulatory filings, investor presentations and media releases, outside activists get only snapshots (often fuzzy ones) of what’s going on inside the company. By contrast, management has the ability to see in high resolution and in three dimensions.

Understanding where and why value is concentrated enables management to prioritize investment in the highest-potential areas for growth and to identify areas where margins need to be improved. Management should use this information to develop a more effective plan than any plan an outsider could create — and do it in advance of being approached by an activist investor.

Management can also best understand which areas of the business are consuming value and then use that knowledge to improve margins through a combination of improving price, enhancing mix and reducing costs. Doing so will improve the company’s long-term health and enhance its ability to serve all its stakeholders. In these cases, management will take many of the same actions an outside activist would — but the managers’ information advantage will enable them to carefully cut with a scalpel, rather than wield an ax.

Step 2: Execute Options to Deliver on Value-Creation Opportunities

Once opportunities for improving margins and enhancing profitable growth have been identified, the activist manager will also have a better-informed view than the outside activist of the best course of action. Not every strategy will work for every company, since each has a unique history and set of capabilities. For that reason, these strategic options need to be grounded in the set of distinctive capabilities that enable the company to deliver in its key markets in a way that competitors cannot match, as well as in management’s understanding of what additional capabilities need to be developed or acquired to support the growth plan.

Once strategies have been agreed upon, they need to be translated into a specific implementation plan that lays out clear roles, responsibilities, actions, resources, key performance indicators and financial commitments.

Step 3: Communicate the Growth Plan to Value-Oriented Investors

The value-maximizing plan must be communicated not only to preempt or respond to an activist, but also to attract shareholders who are seeking long-term value creation. Here again, management should focus on building an information advantage — this time about investors. Understanding and attracting the right type of investors is like understanding and attracting the right type of customers.

Management needs to know the motivations of the company’s current shareholder base and be able to identify investors who don’t hold the stock today but would benefit from holding a position in the future. Senior managers can make their investor relations function a proactive force, rather than an entity that merely responds to investor questions. Management needs to understand which key variables value-oriented investors are using to assess the company and adjust the company’s messages, metrics and methods to tell the value story most effectively.

Leaders of companies in which activists express interest should start from a position of confidence. They already know which management practices work best for the company. The secrets of the activist manager are embedded in the informational advantages that management already possesses. By seizing these advantages, managers can reinvigorate their companies and create long-term profitable growth in ways that competitors, upstarts and activist investors won’t be able to match.