with co-author Michael A. DeBernardis

On April 5, 2016, in a memorandum entitled Fraud Section’s Foreign Corrupt Practices Act Enforcement Plan and Guidance (“Guidance”), the DOJ’s Fraud Section unveiled an initiative to encourage voluntary self-reporting in FCPA cases.

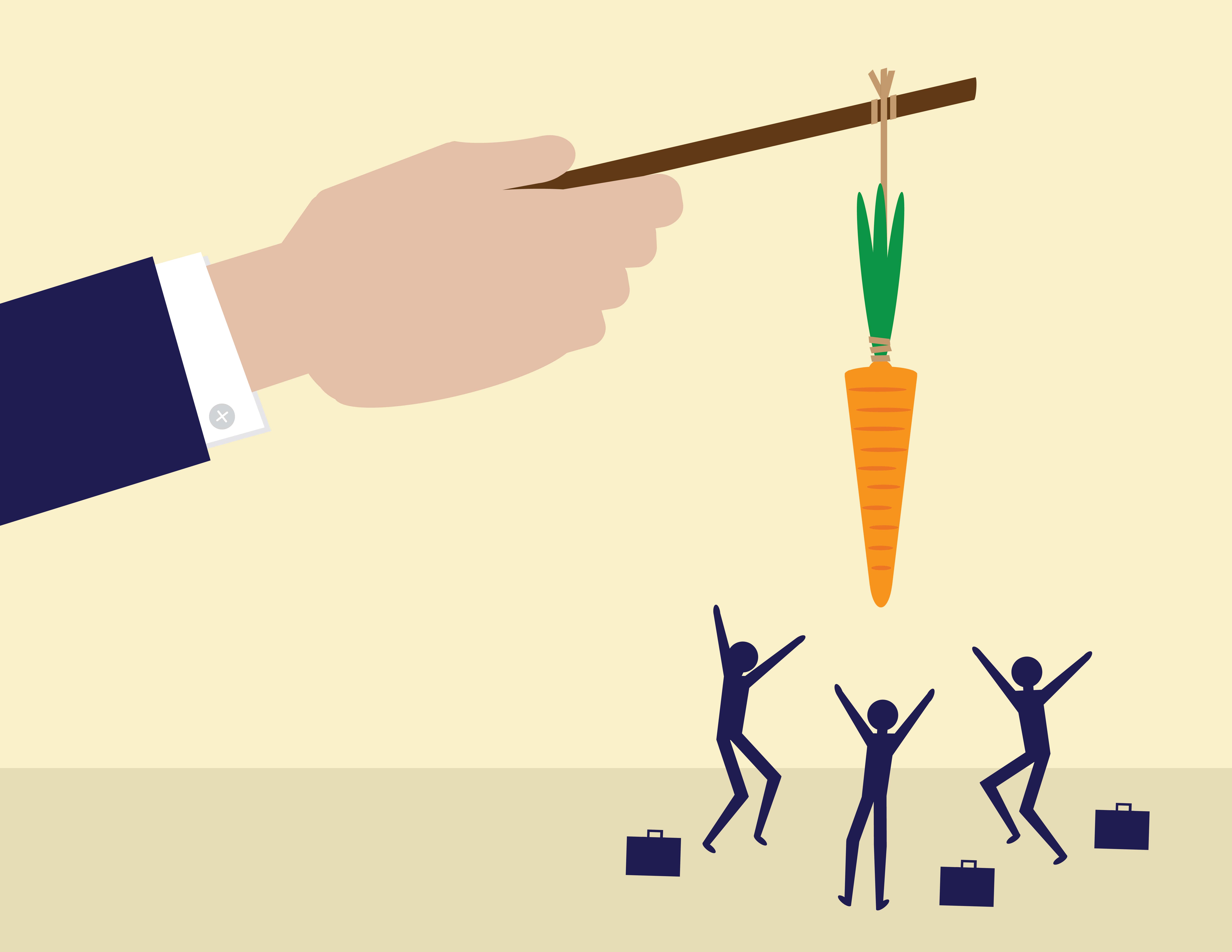

The purported “carrot” is the one-year pilot program laid out by the Guidance, under which the DOJ will allow a reduction of up to 50 percent off the low-end of the applicable U.S. Sentencing Guidelines penalty range for companies that self-report violations, cooperate fully with the DOJ’s subsequent investigation and take steps to remediate the misconduct. In addition, under the pilot program, companies that have implemented an effective compliance program may not be required to retain a corporate compliance monitor. The “stick” is the threat that “FCPA violations that might have gone uncovered in the past are now more likely to come to light.” In particular, the Fraud Section points to: (1) its increase in FCPA investigative and prosecutorial resources through the addition of 10 new prosecutors and three new FBI squads — all dedicated to corruption and (2) the increased collaboration between the DOJ and international law enforcement bodies to combat bribery.

Pilot Program

According to the Guidance, in order to qualify for full credit under the pilot program (50 percent reduction from the otherwise applicable U.S. Sentencing Guidelines penalty range, no compliance monitor and consideration of declination of prosecution), companies must meet certain requirements.

- First, a company must voluntarily disclose the FCPA violation. In order for a disclosure to be considered voluntary, it must occur prior to an “imminent threat” of disclosure by an employee or third party or the initiation of a government investigation, be made within a reasonable time of the company becoming aware of the violation and include all relevant facts (including information regarding the individuals involved). Moreover, a disclosure will not be considered voluntary if the company is required to make it by law, agreement or contract. The Guidance is clear that even with full cooperation and appropriate remediation, absent voluntary disclosure, the Fraud Section’s FCPA Unit will grant a maximum reduction of only 25 percent off the bottom of the U.S. Sentencing Guidelines penalty range.

- Second, a company must provide full cooperation to the Fraud Section’s FCPA Unit. Doubling-down on the so-called Yates Memo issued last year, in order to receive full cooperation credit, a company must be prepared to disclose all facts relevant to the investigation, including the involvement of the company’s officers, employees or agents.

- Third, a company must take appropriate and timely steps to remediate the misconduct, including implementing an effective ethics and compliance program, appropriate discipline of employees and any other steps to reduce the risk of misconduct recurring.

- Finally, to be eligible for the credit, even a company that voluntarily self-discloses, fully cooperates and remediates will be required to disgorge all profits resulting from the FCPA violation.

Potential Impact on the Decision Whether to Voluntarily Disclose an FCPA Violation

Will this program change the equation for a company with knowledge of an FCPA violation? The potential reductions from the otherwise applicable Sentencing Guidelines penalty range under the pilot program are significant, as is the opportunity to avoid the imposition of the compliance monitor or avoid prosecution altogether.

Moreover, the chances of an FCPA violation forever staying “internal” are growing smaller and smaller by the day. The Guidance’s reference to increased cooperation among international enforcement bodies is not just bluster. In the last 18 months, we have seen DOJ settlements arising out of cooperation with the national authorities in the U.K., Indonesia, Switzerland, Germany, the Netherlands, Saudi Arabia, Cyprus and Taiwan, as well as other international organizations such as the African Development Bank. In addition, employees have more incentive than ever to report violations directly to U.S. authorities and collect potentially millions of dollars in whistleblower awards. Finally, as recent headlines such as those covering the Panama Papers demonstrate, the potential for a data breach (either internal or through the work of hackers) that reveals wrongdoing is perhaps at its greatest discovery risk point in history. This would suggest that in some situations a company would be wise to self-disclose misconduct and take the accompanying remediation credit rather than waiting for the DOJ to come knocking on the door.

However, even under the pilot program, there are no guarantees for companies willing to approach the DOJ hat-in-hand. In allowing up to a 50 percent reduction, the Guidance still provides significant discretion to the FCPA Unit under the pilot program in determining how much credit will be given to companies who choose to participate, without any guidance as to how the determination will ultimately be made. The requirement of full disgorgement of profits also allows for a great deal of discretion, as the amount of profit resulting from improper conduct is often difficult to calculate and can be a point of negotiation itself. Given that FCPA settlements can now reach into the billions of dollars, how much comfort will companies take from such a heavily couched offer?

Moreover, it is not clear that the pilot program will actually change the way the FCPA Unit approaches settlements. The DOJ has historically afforded substantial credit to companies that voluntarily disclose FCPA violations, cooperate with an investigation and remediate misconduct–a fact acknowledged in the Guidance. A Resource Guide to the U.S. Foreign Corrupt Practices Act, issued by the DOJ and SEC in 2012, provides several examples of companies that were able to avoid prosecution because the companies voluntarily disclosed the violation, cooperated fully and took appropriate remedial action. It is not clear that the reduction offered under the pilot program is significantly, if at all, greater for those companies willing to voluntarily disclose than it was before.

Ultimately, even if the pilot program does not have the impact that was intended, it remains essential that corporations consider the range of potential consequences and benefits of voluntary self-disclosure, particularly in light of the increasing likelihood that any significant FCPA violation will eventually become public. To make an informed analysis and best protect its interests, it remains as important as ever that a company fully investigate potential wrongdoing in an organized, transparent and defensible manner. It is only after such an investigation that a company can make the difficult decision regarding voluntary disclosure and take the appropriate remedial measures that are essential to prevent similar misconduct in the future.

Benjamin S. Britz is of counsel at Hughes & Hubbard’s Washington, D.C. office. Mr. Britz advises clients on all aspects of corporate governance, including internal investigations, SEC enforcement, anti-corruption compliance, fraud and money laundering matters, shareholder class action and derivative litigation and corporate compliance monitorships.

Mr. Britz has represented clients before all manner of domestic and international enforcement agencies, including the Department of Justice, Securities and Exchange Commission, U.K. Serious Fraud Office and the enforcement offices of the World Bank, Asian Development Bank and African Development Bank, among others. His practice particularly focuses on anti-corruption compliance, securities enforcement and accounting and procurement fraud matters. He has performed internal investigations and due diligence exercises around the globe and across an array of different industries.

Mr. Britz has particular experience in conducting corporate compliance monitorships and compliance program evaluations, and he has assisted American, European, African and Asian clients in designing, administering and maintaining anti-corruption, integrity compliance, anti-money laundering and corporate governance programs.

Mr. Britz has also successfully defended numerous clients in multilateral development bank (MDB) sanctions proceedings such as where corruption, fraud or other misconduct in MDB-financed projects is suspected. He also regularly represents companies and individuals in shareholder class action and derivative litigations.

Prior to joining Hughes Hubbard, Mr. Britz clerked on the United States District Court for the Northern District of Ohio for Chief Judge James G. Carr.

Benjamin S. Britz is of counsel at Hughes & Hubbard’s Washington, D.C. office. Mr. Britz advises clients on all aspects of corporate governance, including internal investigations, SEC enforcement, anti-corruption compliance, fraud and money laundering matters, shareholder class action and derivative litigation and corporate compliance monitorships.

Mr. Britz has represented clients before all manner of domestic and international enforcement agencies, including the Department of Justice, Securities and Exchange Commission, U.K. Serious Fraud Office and the enforcement offices of the World Bank, Asian Development Bank and African Development Bank, among others. His practice particularly focuses on anti-corruption compliance, securities enforcement and accounting and procurement fraud matters. He has performed internal investigations and due diligence exercises around the globe and across an array of different industries.

Mr. Britz has particular experience in conducting corporate compliance monitorships and compliance program evaluations, and he has assisted American, European, African and Asian clients in designing, administering and maintaining anti-corruption, integrity compliance, anti-money laundering and corporate governance programs.

Mr. Britz has also successfully defended numerous clients in multilateral development bank (MDB) sanctions proceedings such as where corruption, fraud or other misconduct in MDB-financed projects is suspected. He also regularly represents companies and individuals in shareholder class action and derivative litigations.

Prior to joining Hughes Hubbard, Mr. Britz clerked on the United States District Court for the Northern District of Ohio for Chief Judge James G. Carr.