Ron Kral espouses the benefits of a well-designed system for financial reporting controls and provides five ways organizations can improve the effectiveness of their ICFR process.

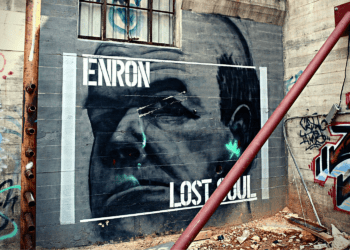

When Congress first mandated SOX for public companies, requiring them to document and assess internal controls over financial reporting (ICFR), many executives viewed the requirement simply as a compliance exercise. While some may continue to feel this way, the more successful companies have recognized that a well-designed control system can deliver greater efficiencies to a business. Companies that have successfully ingrained a healthy ICFR process into their cultures realize the most value and best controls for detecting and preventing material errors or fraud in financial reporting. As advisors and trainers of controls, we are often surprised at how many organizations continue to struggle in recognizing the dynamic nature of ICFR and the related purposes and business benefits. The struggles frequently stem from not fully understanding and communicating the objectives, risks and opportunities, as well as not finding the right balance of controls in evolving business environments.

The “golden triangle” of people, process and technology as the three elements for a successful organization is commonly spoken about in business circles. All three are also critical for effective internal control. Indeed, The Committee of Sponsoring Organizations of the Treadway Commission (COSO) in their publication Internal Control – Integrated Framework (2013) directly brings light to people and processes through their definition of “internal control” as:

A process, effected by an entity’s board of directors, management and other personnel, designed to provide reasonable assurance regarding the achievement of objectives relating to operations, reporting and compliance.

Keep in mind that “control” and “control activity” are related terms defined respectively as 1) a policy or procedure that is part of internal control, and 2) actions established through policies and procedures to help ensure that management’s (and the board’s) directives to mitigate risks to achieve objectives are carried out. The linkage between objectives, risks (and opportunities), and controls is central to these definitions.

How to Increase the Effectiveness of Your ICFR Process

1. Invite Control Owners to Take a More Active Role in the Process

Both top-down and bottom-up communications should be part of the ICFR process. First, the executive team, led by the CEO, sets the tone of the control environment through their words and actions. There is no more important internal control topic than this one. Ideally, not only do top-down communications stress the importance of adhering to policies and procedures, but the culture should emphasize the importance of soliciting communications from the control owners in the trenches (i.e., bottom-up communications). This is a great avenue for management to hear creative ideas for improvement. Once control owners fully understand the relationship between the objective, risk/opportunity and control response, they are now in a position to contribute ideas, rather than simply taking marching orders.

Oftentimes, control owners at the lower levels of an organization are in a prime position to see what works and doesn’t since they are closest to the customers (both internal and external), vendors and other stakeholder groups. Recognizing their ideas helps management to obtain a diverse set of ideas while also allowing control owners to serve a more important process role. As control owners feel like they are contributing to the solution, they are more likely to embrace controls in knowing how their actions help achieve objectives.

ICFR success is contingent on understanding the objectives and relating risks and opportunities, and then focusing on controls to best address the risks and opportunities in the spirit of meeting financial reporting objectives.

2. Keep Controls in Tune with Changing Objectives and Risks

Too many times, controls are viewed from a static perspective rather than from a dynamic perspective that must keep pace with changing internal and external environments. Financial reporting objectives and associated risks are constantly changing due to new accounting pronouncements, new products and services, expanding market places, acquisitions and divestitures, etc. It is vitally important for the control response to be revised in concert with the changing objective and risk landscapes.

For example, the new lease accounting standard (ASC 842) requires that nearly all leases create an asset and a liability, including some embedded leases of equipment in service contracts. The associated changes introduce more judgments and directly impact the five financial statement assertions of existence, completeness, rights and obligations, accuracy and valuation and presentation and disclosure, all of which are objectives with associated risks. Obviously, the impact of ICFR changes is significant moving from ASC 840 to 842.

Never start with the design of a control and back into the objectives and risks. Remember the logic of starting with the objective first and then considering associated risks and opportunities. The controls should then be built to address the risks and opportunities to best achieve objectives. This logic should be central to the ICFR process in clearly identifying these elements and alerting responsible management when an objective or risk changes so controls can be revised accordingly. When discussing potential business transactions or future plans, executives should ask, “and how will this impact our objectives, risks, opportunities and controls?”

3. Keep a Healthy Dose of Independent Monitoring in the Process

Monitoring activities assess whether controls are occurring as intended. It is wise to invoke people who are not control owners for conducting periodic ICFR evaluations to help ensure candid results. While management should clearly be supervising and monitoring controls under them, an independent assessment introduces greater objectivity along with the opportunity of fresh ideas. Utilizing an internal audit function or a third-party resource are viable options.

For public companies responsible for periodic reports to the U.S. Securities and Exchange Commission (SEC), an annual revaluation of ICFR is required. According to the SEC’s Release #33-8810 & #34-55929 (Interpretive Release), “the purpose of the evaluation of ICFR is to provide management with a reasonable basis for its annual assessment as to whether any material weaknesses in ICFR exist as of the end of the fiscal year.”

The Interpretive Release provides guidance for management in evaluating and assessing ICFR. The concepts of reasonable judgment, scalability and risk are central themes. Additionally, the Interpretive Release advocates a top-down, risk-based approach to identify risks and controls and in determining evidential matter necessary to support the assessment. Although dating back to 2007, this is a release that should be periodically revisited by management of all public companies as guidance to their process. Other nonpublic organizations can also benefit from this guidance.

4. Take Timely Actions in Addressing Control Deficiencies

The ICFR process needs to have a corrective action component to address control deficiencies. Deficiencies can be identified in the design (i.e., the policies and procedures) or lack of design of controls, as well as a lack of operating effectiveness of control activities, which simply means that control owners and systems are not performing as intended per management directives. Failing to take timely action to address deficiencies can take a heavy toll on the culture.

In early 2019, the SEC filed and settled enforcement actions against four pubic companies for failing to maintain adequate ICFR. In each of these cases, companies had disclosed material control weaknesses, but failed to correct those weaknesses for many years. These charges demonstrate that the SEC is committed to holding public companies accountable for failing to timely remediate material weaknesses.

Corrective actions to address control deficiencies need to be addressed in a timely manner. The ICFR process should include ample activities to ensure proper remediation efforts, including identifying who has primary responsibility, what actions will be taken and when and independent monitoring to ensure deficiencies have been completely addressed.

5. Strive for Continuous Improvement

Remember that defining and executing ICFR is resource intensive. While controls serve an important role to detect and prevent material errors or fraud in financial reporting, their value and effectiveness should be periodically challenged. Questions should be asked, such as:

- Do we have too many controls (or too few)?

- Are they understood?

- What are the associated costs and benefits?

- Are they effective?

- Can they be automated?

Like any process, a focus on improvement should be a constant.

While there are many other considerations toward a healthy ICFR process, these five points should be ingrained in any internal control process, including ICFR. A proactive process will serve as the critical ingredient in a successful ICFR recipe.

This piece was originally shared in the Governance Issues™ Newsletter, published by Kral Ussery LLC, and is republished here with permission.

Ron Kral is a partner of

Ron Kral is a partner of